Intraday Trading Example

More on Intraday Trading

Intraday trading is nothing but opening and closing the position in a day. But most of the beginners found it a little complicated and therefore here we are with the complete information on the Intraday Trading example.

Without wasting much time let’s dive into the details of intraday trading and grab its understanding with some of the examples.

Intraday Trading with Example

“Frankly, I don’t see markets; I see risks, rewards, and money.”

– Larry Hite

This quote goes the best with intraday trading that brings lots of opportunities for traders to trade in different segments and end up earning profits.

But one can make a profit only when trading is done strategically and to do it perfectly one needs to be aware of all the aspects of day trade.

Let’s make it easier for you with the simple intraday trading example.

Going to school is meant for gaining education where you need to spend 8 hours daily to learn different subjects.

Similarly, the market opens for 9 hours each day.

Every day in school you get an opportunity to learn something new. In the stock market, every day you come across a market condition that can help you in earning profit.

Now there are many schools, you can end up building a better future when you get an education from the best school. In intraday trading, you need to pick the sector that is in news and it brings up an opportunity for you to trade well.

Similar to school there are subjects that can be a scrip in intraday trading.

Choosing the right subject according to the career demand can help you in making and choosing your career. Similar is the case of day trade, where you have to pick the right stock for intraday trading trending in the market.

In both cases, the decision of choosing the wrong subject in case of school and wrong scrip in case of trade can lead to losses.

This is how trading works and now let’s see how to trade intraday in different segments.

Intraday Trading in Equity

The stock market gives you multiple trading options including equity, commodity, and currency.

The equity market involves the companies that are listed in the NSE and BSE.

Some of the examples of equity shares include Reliance, Infosys, TCS, etc.

Now, most beginners think that the equity market can reap a good profit and returns only in long-term investment. But that is not true. There are many equity stocks with a specific number of shares available for retail and institutional investors that can reap a good profit in a day.

Wondering how?

Well! For that, you need to stay updated with the market news.

For example, the government is planning for some kind of advancement in the Pharmaceutical sector. This will help the cement companies to grow in the long term bringing an opportunity for traders to trade in positional trade.

Also, this will increase the demand of the companies concerned with the Pharma manufacturing and hence its stock prices increase thus bringing an opportunity for day traders to earn profit.

Let’s understand it better with the intraday trading example.

Vinay came across the news of the Pharmaceutical sector and decided to buy stocks of Crisil after doing the technical analysis of stocks. The CMP of the share was ₹300 at 9:30 AM. He bought 100 shares.

Seeing the good growth he decided to sell off 50 shares at ₹306 each thus making an overall profit of ₹300.

Now seeing the potential of good profit he again bought 50 shares of Crisil at ₹304 each and waited for a few hours.

At 2 PM he sold the 100 shares at ₹310 each thus making a profit of ₹800.

Overall, Vinay was able to earn a profit of ₹1100 in 6 hours.

Like the positive market, the news brings in an opportunity for traders to earn profit from the downtrend, the negative news around the sector or stock lead to the downward movement.

Intraday trading is again a profitable option even when the market is falling down.

For this, you can opt for short selling, where you can sell first and buy later at a lower price.

In both cases, it is good to close your position before the trading hours end. Failing to do so the penalty or auto square off charges are levied upon you that again varies from broker to broker.

Intraday Trading in Options

Intraday trading in the equity is profitable but at the same time is risky.

Most of the traders want to earn profit but most of the time they are not risk-takers. For this, they opt for options trading in intraday trading.

Yes! You read it correctly.

Intraday trading in options can be done by buying or selling the contract in the morning and squaring off the position before the market closes.

Options trading is profitable when the stocks you picked consolidates for the rest of the day or you are bullish/bearish but want to hedge your risk at the same time.

Intraday trading in options involves lots of studies and the right use of the strategy. Get a better understanding of intraday options trading with intraday trading example.

For let’s say, you are bullish for Reliance (CMP ₹345) and thus buy Out of the money @₹350 by paying the premium of ₹5 per share (50 shares per lot).

Now, let’s say the stock price reaches ₹365 by mid-day. Hence you exercise the contract and sell of the shares in the equity market making a profit of ₹15 per share.

Also, you can settle the option contract in cash making a profit of ₹750 out of it.

Apart from the equity market, options contracts are traded in commodity and currency as well thus bringing in many more opportunities for traders to execute day trade by hedging their risk at the same time.

These are the specific intraday trading example in different segments. Now let’s know how to execute the trade intraday in different segments.

How to do Intraday Trading?

Many times day trader knows what intraday trading is but when it comes to executing the trade, many beginners fail.

And so, here we are with the complete explanation of the intraday trading example.

The most important step to initiate intraday trading is to open a trading account with a renowned stockbroker.

This helps you in managing your trade and also offers you the trading platforms that further help you in analyzing stocks and placing buy or sell orders seamlessly.

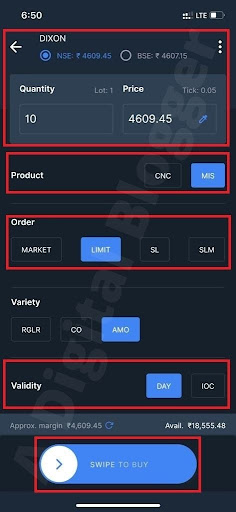

- To do intraday trading, the next step is to download the app and log in using the user id and password.

- Now select the stock and segment for trading.

- Click on Buy/Sell option.

- A new window opens where you need to enter details like Quantity, Price, Product & Order Type, and then execute the trade as shown below.

- To minimize the risks, you can opt for the advanced order type (Stop loss, bracket order or cover order).

- After filling in all the details, confirm your order.

Note: Here, the screenshots of Zerodha Platforms are used for reference.

Now from picking the right stock to making the right entry and exit, technical analysis of stocks plays a vital role in intraday trading. So, if you are a beginner then it is better to gain an understanding of the important concepts.

For this, there are many available options like online courses, youtube channels, and of course technical analysis books.

You can find the one that covers most of the concepts that you want to learn and make a smart entry into the market.

How Much Money is Required for Intraday Trading?

Till yet we talked about the process and different trading segments available for intraday trading but here is the question of how much amount you need to do intraday trading or the minimum amount to trade in intraday.

The simple and straight answer for this all depends upon you.

How much extra money do you have? What is your risk appetite? How much profit you are looking for?

And, last but not the least, how much loss you can suffer in case the market trend reverse.

Getting the answer to all these questions helps you in knowing the amount you need to trade in intraday.

In short, there is no specific amount that is defined in the stock market for doing intraday trading. You can start with as small as ₹1 and trade in stocks up to ₹1,00,000 or more.

Again, the final amount of trading depends upon you.

Conclusion

The situation of entering into the intraday market as a newbie creates a lot of confusion if the concept is not clearly understood. The intraday trading example makes it easier for you to understand and execute the trading seamlessly.

Hence, to make it possible, the informative piece over an intraday trading example helps the trader to know more about how to trade in intraday trading in various segments like equity and option.

So, it is high time to understand, learn and trade efficiently!

HAPPY TRADING!!

Get into the trade with the renowned stockbrokers in India by opening a demat account online.

More on Intraday Trading