Intraday Trading Strategies

More on Intraday Trading

Intraday Trading Strategies require intermediate to an advanced level understanding of how different aspects such as intraday charts, trading indicators, candlestick patterns, intraday trading tricks work together.

If you are a beginner, it makes total sense to understand at least the basics of these concepts instead of directly employing these strategies in your trades.

But before that, let’s take a step back and understand the basics to learn intraday trading.

Intraday trading involves making short-term trades, lasting less than a day (sometimes a few seconds or minutes), in order to make profits from the financial markets.

There are many myths and beliefs around day trading including the different Intraday Trading Strategies used by different traders to avoid Intraday Trading Mistakes.

Some people believe that it is a way to get rich real quick, which is not always the case, while others believe that it is impossible to hold on to making profits from intraday trading in the long term, which is again not always true.

At the same time, a lot of traders put their emphasis on different intraday trading tools, which is not a bad ploy either.

However, you need to set up specific objectives and corresponding strategies first before you start using those tools.

Intraday Trading Strategies in India

Intraday trading is a balancing act.

It needs sheer dedication, hard work, patience, quick wit, and immense knowledge to be successful in intraday trading. Successful intraday trading involves 90% waiting and 10% execution.

So, yes, it can make a trader rich in a relatively short period of time if the correct processes are followed, and yes, it is possible to hold on to the profits in the long-term if the correct strategies are followed.

It takes a fair amount of time to gain expertise in day trading, to hone the trading skills and to get established.

Theoretically, there are numerous intraday trading strategies.

However, the success or failure of a particular intraday trading strategy totally depends on the market. A strategy may be working for the market conditions today, but may not work according to the next day’s market conditions.

An intraday trader has to be very flexible and adaptable. He needs to keep practicing the strategies and working on his skills, and constantly adjust to the new scenarios and adapt his strategies accordingly.

In fact, the use of intraday trading strategies also varies at different times of the day, depending upon how the market is behaving and how it has to be dealt with.

The intraday trader should be ready to face the unexpected and accept the challenges.

The intraday trading strategy to be used also depends upon the traders’ personal trading styles, along with being dependent on the market conditions.

Some traders are very active and do many trades a day, with large position sizes, catching even the small price movements; while there are others who trade only on specific news events or only on tendencies that they have well researched.

So, a strategy that works for a very active trader may not work for a less active one and vice versa.

In this day and age, with regular technology upgrades, algo-trading has picked up pace in the recent past. Make sure you understand different algo trading strategies as well if you consider using that form of trading.

Top 7 Intraday Trading Strategies

Following are the Top 7 Intraday Trading Strategies that have been successfully used and implemented by the day traders. Again, the success of the strategies is quite subjective and therefore intraday trading beginners must use it along with other indicators and other tools.

Momentum Trading Strategy

Day trading is all about momentum. It is about finding the stocks that are moving. There are at least some stocks that move 20-30% every day. The key is to find these stocks before they make a big move and catch that move.

Stock scanners can be used to find such stocks.

These stocks with potential momentum move above the Moving Averages and with no close resistance and have high relative volume.

The momentum can be due to a fundamental catalyst like earnings, but the momentum can also be caused without a fundamental backup and is called a technical breakout.

Thus in momentum trading strategy, the traders focus on stocks with momentum, i.e. the stocks that are significantly moving in one direction and in high volume.

The positions can be held for minutes, hours or for the entire day, depending on the speed of the movement of the security and when it changes direction.

Momentum Trading Strategy mostly works at the beginning of trading hours or at the time of a news spike which brings huge volume into security and the trade is mostly done at a 2:1 profit loss ratio.

This is one of those Intraday Trading Strategies that can bring a quick impact on your profits assuming you on your toes as the trade session begins.

Reversal Trading Strategy

Reversal Trading Strategy is one of those Intraday trading strategies that give a chance to enter the security very close to support. As it is always said, buy low and sell high, this trading strategy helps to take a position on the security very close to the support level and gives an opportunity to set the stops.

The stop in reversal trading strategy is always very close as the position is to take close to the closest high or low. This helps to provide a good risk to reward ratio.

Reversal intraday trading strategy keeps the bar low and success rates high-who do not want that!

In reversal intraday trading strategies, the traders look for the stocks that are the extreme highs or lows and thus have a great snapback potential.

As soon as the security begins to reverse, a stop is marked and trailing stops are used to stay in the trade for as long as possible.

A reversal strategy trader waiting for the security to show reversal closes his existing long position and takes a short position to capitalize on the downward price movement, or closes the short position to stop incurring any losses in intraday trading and takes a long position to benefit from the upward price movement.

Also Read: Swing Trading Strategies

Gap & Go Trading Strategy

The Gap & Go! is one of those Intraday Trading Strategies that capitalizes on the gappers.

Gappers are the securities that show a gap between the prices on a chart when there is an upward or downward movement in the price with no trading in between.

Gaps can be created by various factors like earnings announcements, any other type of news releases or a change in the outlook of the analysts.

Gaps mostly occur at the opening time of the exchanges due to a difference in demand and supply and are quite common.

These gaps are tapped on by the experienced intraday traders to earn profits before the gaps are filled due to the establishment of equilibrium.

Gappers are observed in the first hour of trading and a range is established; rising above the range signals a buy and going below the range signals a sell.

The gap and go strategy traders look for gappers and as a thumb rule, take a position in the same direction as the minor trend. For gaps in the direction opposite to the minor trend, positions are taken contrary to the minor trend with a very tight stop-loss.

The most important characteristic of the gap and go intraday trading strategy is making quick small profits with very low risks.

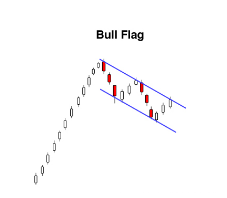

Bull Flag Trading Strategy

A flag is a pattern formed when there is an explosively strong price move that forms the flagpole, followed by a systematic and diagonally symmetric pullback, which forms the flag.

When the resistance line in the flag breaks, it forms the next leg of the trend move, and security moves ahead.

Bull Flag, in particular, shows a strong price hike that reaches its peak and then pulls back in an orderly fashion where the highs and lows are almost parallel to each other. Bulls flags are violent in the beginning as the bulls cause a breakout and blindside the bears.

Bull Flag Intraday Trading Strategy involves a lot of patience to wait for the flag to form, and then form the upper and lower trend lines.

Then two spots of entry into the trade are marked, one on the flag break and the other on the break of the high. Also, stop-loss points are marked usually under the upper trend line on uptrends.

In order to derive the target prices in a bull flag pattern, various technical indicators are used like the Bollinger Bands or Stochastic Oscillator.

Pull Back Trading Strategy

A pullback is a term used to describe a short-term move insecurity in the opposite direction of a long-term trend. It gives a chance to join the trend without following the security.

In the world of intraday trading, it is often said that ‘Trend is your friend’, which is quite true; however, the pullback intraday trading strategy helps to protect the trader from drowning when he is swimming with the trend.

Firstly, it has to be clearly understood that the pullback is actually a pullback and not a trend reversal.

This can be done by observing the volumes and taking a look at the last trading day.

In a pullback intraday trading strategy, weaknesses are bought and strengths are sold.

Securities that are up trending will pull back giving a low-risk buying opportunity, and securities that are down-trending will go up offering a low-risk selling opportunity.

Pullbacks are mostly bought in the Traders Action Zone. Another great opportunity to enter into buying a pullback is right after a breakout.

Breakout Trading Strategy

Break out trading means entering the market when the price moves outside a particular price range, its own support and resistance. It is accompanied by an increase in volume.

Traders make use of the technical indicator Volume Weighted Moving Average to understand and catch breakouts.

The keyword for Breakout Trading Strategy is quickness. It needs very quick and aggressive entries and exits. It is one of those instant intraday trading strategies which does not involve waiting; traders know it right then if the trade is going to work or not.

Traders following the Breakout Intraday Trading Strategy identify a price level which can be their breakout trading level, wait for a breakout and identify the resistance level and then wait for the break out to close above the resistance level.

However, breakout trading is quite risky as the traders are buying the security that everyone else is, and there is hardly anyone left to buy it after the traders get in.

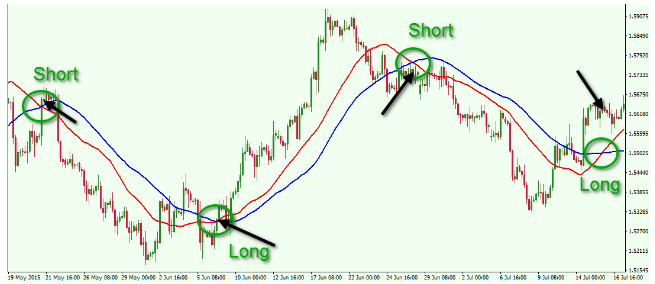

Moving Average Crossover Strategy

Moving average crossover intraday trading strategy is basically a price crossover strategy.

When the price of a security goes above or below a moving average, it signals a potential change in trend. This strategy eliminates all emotion.

It clearly shows the change in momentum when the price of the security crosses over from one side of the moving average to the other.

A crossover below the moving average signals downtrend and a crossover above the moving average shows an uptrend.

Another type of crossover happens when a short-term average crosses a long-term average. This signals that a strong move is likely to come.

When the short-term average crosses above the long-term average, a buy signal is generated and when the short-term average crosses below the long-term average, a sell signal is generated.

RSI Strategy for Intraday

Now when discussing the MACD then why not the RSI, it is the momentum indicator that gives an idea of a trend reversal to the traders.

The indicator has the range of 30-70 that gives an idea of oversold and overbought condition respectively and eventually help traders to make a decision of going long or short.

When it comes to setting the RSI for intraday, it is better to use the shorter time frame of 5 or 8 as it increases the sensitivity of the trend and thus gives a better idea of the trend or its reversal to the trader.

Here in the image below, we have used three different periods for RSI (5,8,14).

Although all the periods give similar information when it comes to the sensitivity of the information, RSI 5 proves to be the best in predicting the trend.

Conclusion

Thus, conclusively, multiple strategies are available to be used by the intraday traders, but the use of the correct strategy at the correct time is the key.

There are only 4.5% of the intraday traders who end up successful and those are the ones who not only understand and implement the intraday trading strategies but do it at the right time, with sheer dedication and resilience.

The strategies are to be tried and tested and then implemented to make profits. Along with the use of strategies, the trading disciple and the emotional instinct of the intraday trader play a very crucial role in success.

In case, you are looking to perform intraday trading but do not know which stockbroker suits the best for you, just fill in your details below.

We will arrange a callback for You, absolutely free!

More on Share Market Education:

If you want to learn more about Intraday Trading Strategies or topics related to Intraday Trading in general, here are a few references for you:

This is very interesting, You are a very skilled blogger.

I have joined your feed and look forward to seeking more of your wonderful post.

Also, I’ve shared your web site in my social

networks!

Nice

Hi, You have really explained well about intraday trading strategy its best to use it intraday as the newsflow means no fundamental shifts to the market and relative stability in the underlying assumptions. Smart traders may wish to use the 15 minutes/1-hour candles to create these strategies. Lesser may mean transactions costs will eat into profits and higher may mean too much interference with underlying markets.

Very informative, thanks!

Yes, definitely interesting.

Will need to study more before actually doing it in the live market.