How to Put Stop Loss in Kotak Securities?

Kotak Securities comes up with one of the highly advanced and one of the best trading apps in India. So, if you are trading with the broker, then here is the information on how to put stop loss in Kotak Securities app.

Stop-loss as the name suggests, stops or adds a limit to the price, thus preventing the traders from incurring much loss in the highly volatile market, but the major question here is how to calculate stop loss?

Let’s dive in to know how to make the best use of the Kotak Securities App to place stop-loss order.

How to Put Stop Loss in Kotak Securities App?

Short-term trading comes with the risk and therefore when gaining an understanding of how to do intraday trading in Kotak Securities, it becomes equally important to learn about the stop-loss order and how to execute them in the app.

To set the desired stop loss while placing an order in Kotak Securities follow the steps below:

- Log in to your Kotak trading account using your login credentials.

- Once you have successfully logged in, you can easily choose your shares in which you want to trade.

- Click on the ‘buy/sell’ option. By the way, we hope you know how to buy shares in Kotak Securities app already.

- A buy window will pop up on the screen.

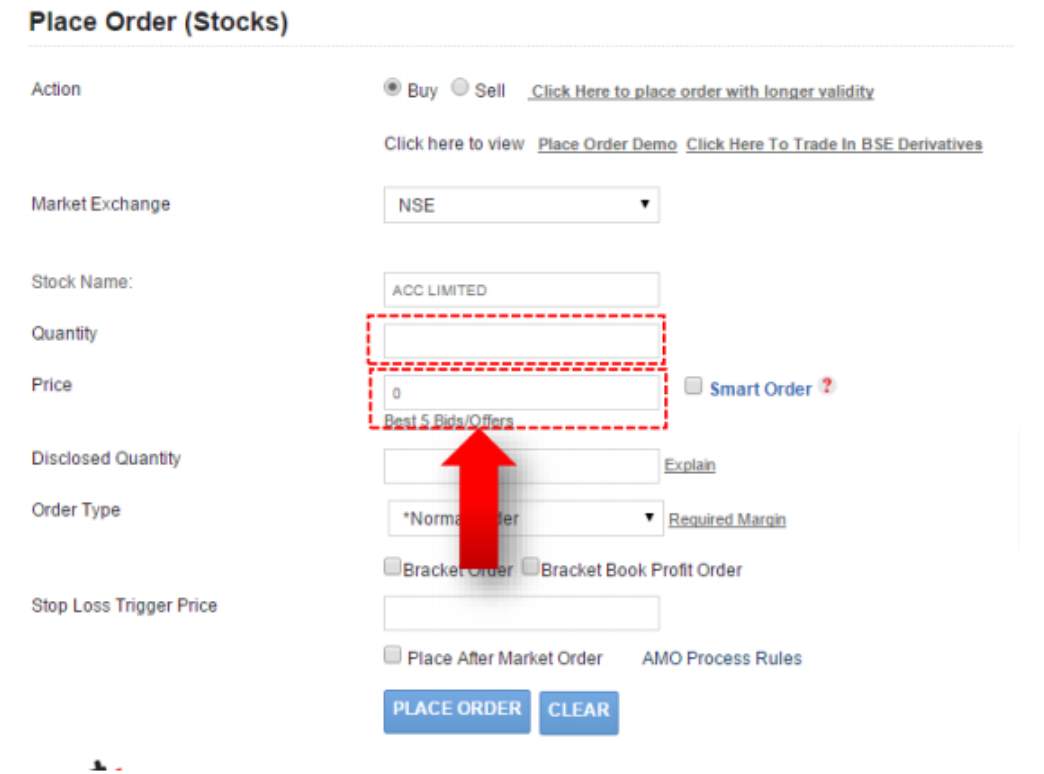

- Now you can add the quantity, buy/sell price, choose the exchange, and then click on advanced order.

- Under advanced order click on ‘stop-loss order’

- Select a trigger price, and a stop loss (maximum price till which you can incur losses)

- Confirm your order and click on submit.

Your order will be placed successfully.

Now if the market does not perform as per your prediction and reverses its direction, then as soon as the stop-loss price is hit your sell/buy order gets triggered thus preventing you from facing much loss.

Let us understand how stop-loss works with the help of an example. Geeta wants to buy 100 shares of XYZ company at a price of ₹100 each. She is skeptical about the market is bullish, so she puts a stop loss at ₹96 and a trigger price at ₹97.

Thus, Geeta would be able to exit her position somewhere between ₹97-₹96 thus suffering the maximum loss of ₹4.

How to Put Trailing Stop Loss in Kotak Securities?

You can also put a trailing stop loss in Kotak Securities and also its different apps. Trailing stop loss as the name suggests is the one that trails or follows.

Kotak Securities gives you the chance to put the trailing stop loss on your order. Let us look at the procedure.

- Log in to your Kotak Securities mobile app using your login ID and password.

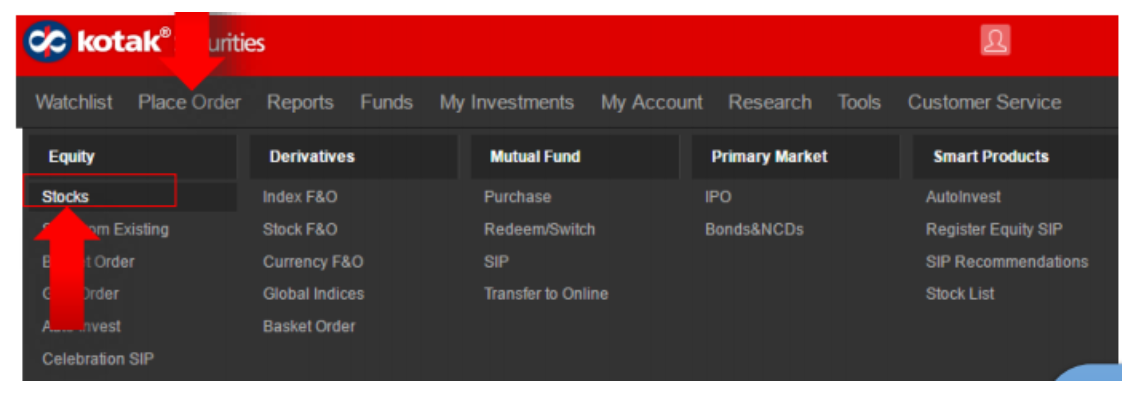

- Now on the ‘Place Order’ menu click on stocks or derivatives options.

- Now select either buy or sell.

- Also, select the exchange (BSE or NSE)

- After this, select the scrip from the dropdown menu.

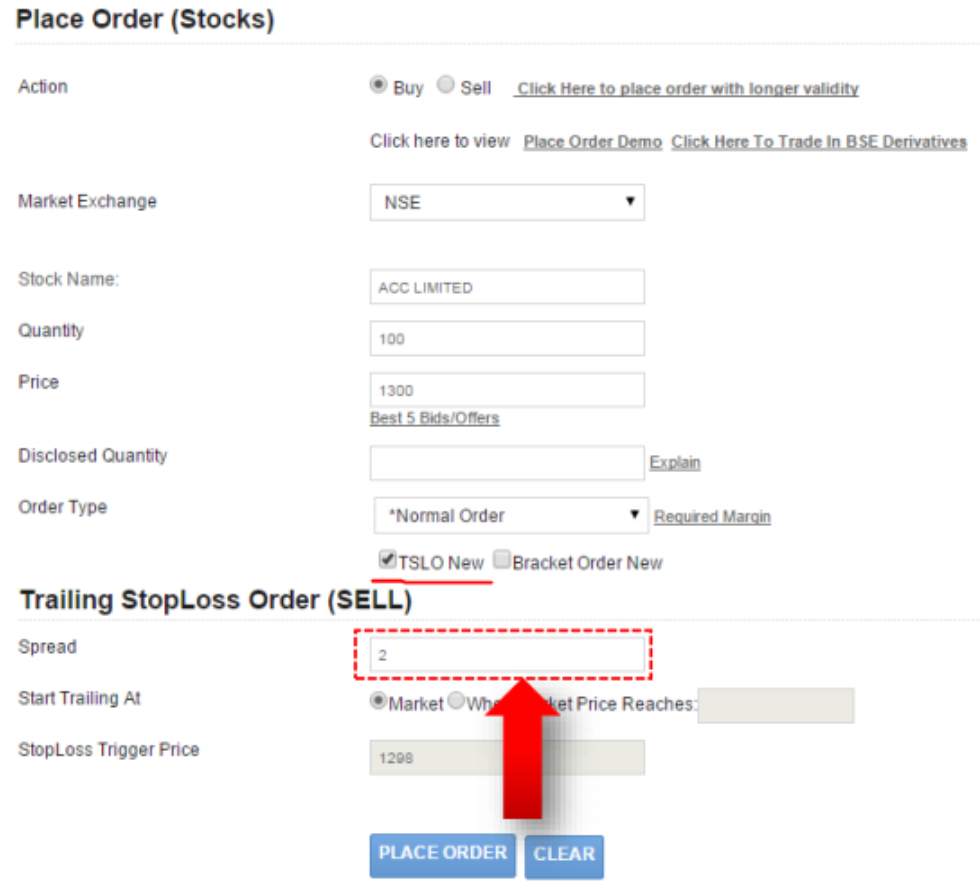

- Fill in the details of the quantity (100) and price (₹100) that you desire.

- Now select ‘TSLO’ (trailing stop-loss order)

- After you select the trailing stop loss, a lot of other options will also appear on the screen.

- Now enter the spread (2) according to which your stop loss will be calculated by the system.

- Click on ‘place order’ to apply your trailing stop loss.

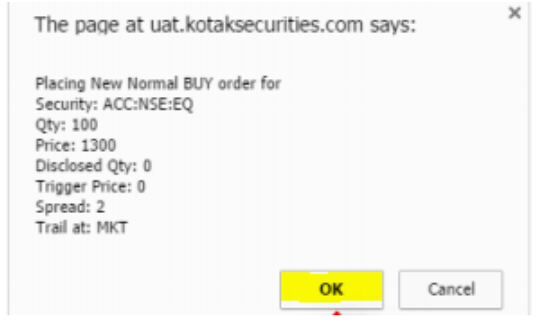

- Review your order, and press confirm.

- You will be given a reference number and your trailing stop-loss will be set.

Now suppose the market price of the stock reaches ₹150 then the stop loss trailed at the rate of 0.5 i.e. with an increase in the value of ₹1 the stop loss moves up by 0.5 points.

Since there is a price difference of ₹50 thus the new stop loss would be ₹121 (96+25)

Conclusion

Kotak Securities apps are easy to use and setting stop-loss using the trading app can prevent you from losses in both intraday and delivery trading.

Since you have learned about how to put stop loss in Kotak Securities, therefore, you can trade with the minimum risk by downloading the app now.

If in case, you’d like to learn more about using the Kotak Securities Mobile app or anything related to it, just fill in a few details in the form below and we will call you back:

Learn More about Kotak Securities: