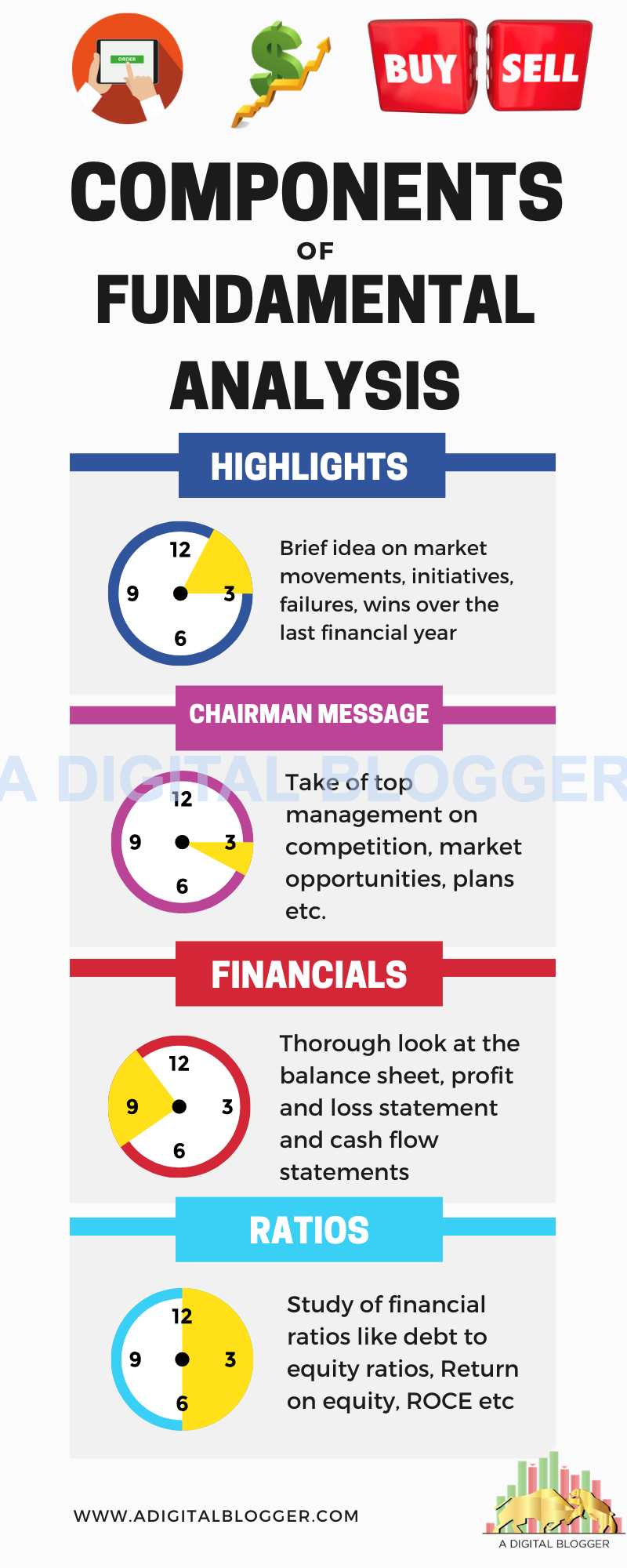

Components of Fundamental Analysis

More on Share Market Analysis

Fundamental analysis of stocks is one of the most reliable methods of finding the intrinsic value of any stock. It covers all the most important aspects of a company, its working and financial health to reach the final intrinsic value of its stock. But what exactly are the components of fundamental analysis?

Well, it is certainly a valid question! As one would definitely want to understand the aspects to look forward to in order to perform the analysis of stocks.

First of all, once it can be established that the stock is currently underpriced in comparison to its value that has been reached through fundamental analysis, it becomes kind of a safe investment.

Furthermore, the annual report of any public company is the best source to do fundamental analysis. The whole annual report is extremely lengthy and it is very difficult to find time to read the whole of it.

Thus, out of the most components of fundamental analysis, you should be focussing on the sections that contain the most relevant information about the company and its financials.

Components of Fundamental Analysis Review

The sections that talk about performance highlights of a company, message of the Chairman or management discussion, and financials are the most important sections to find all the required knowledge about a company.

The performance highlights would give a brief idea about the last financial year.

The section about the Chairman’s message is also an important place to look for what the top management of the company has to say about the company in particular as well as the whole sector and its opportunities and threats, etc.

The last and one of the most important components of fundamental analysis is the financials of the company.

In order to make sense of the financial statements section of the annual report, one should know how to read and interpret different things mentions in the balance sheet, profit and loss statement and cash flow statement of a company.

Usually, the previous years’ financial statements are also available in an annual report with the help of which a comparison can be made of its financial performance over a period of time.

Besides the financial statements, there are financial ratios that are derived from different items of the financial statements.

The study of these financial ratios like debt to equity ratios, quick ratio, return on equity, return on capital employed, turnover ratios, etc. is very important in finding out the financial health of a company and their comparison with the ratios of a company’s peers is also very important to know the actual standing of a company in its particular sector.

In order to do good quality fundamental analysis, it is important to have theoretical knowledge about the important aspects of it. we would personally suggest you do a short stock market course on fundamental analysis.

There is this stock market education app called Stock Pathshala which provides many such online stock market-related courses for beginners as well as people with intermediate and expert level of knowledge.

So for all those who are looking ahead from where to learn stock market, here is the platform that can help you in gaining knowledge right from the scratch.

However, in case you are looking to perform stock market trading or investments, let us assist you in taking the next steps ahead.

Just fill in some basic details below to get started:

More on Stock Market Analysis

If you wish to learn more about how to carry out the different forms of stock market analysis, here are a few references for you: