Technical Analysis Tools

More on Share Market Analysis

Technical Analysis Tools are like the pedals while you sail a boat. Your boat will reach the shore even if you don’t row it but with the help of these tools, you can row in the direction you want.

Many investors use technical analysis to find the right stock for trading. This analysis is used by investors mainly for day trading. It sounds simple to do day trading but needs a well-experienced eye to catch the movement of a stock.

Nobody in the stock market makes a profit every time, and there will be a day when one will lose money also.

But, if you have expertise in spotting market trends, you can make a good profit from intraday.

Technical analysis is a method of forecasting the direction of the stock price on the basis of past market price and volume of the stock. And to do intraday technical analysis some tools are available in the market which makes analysis easy up to a maximum extent.

Nowadays market players are more active, they are ready to do everything to earn a good profit from the market. Technical analysis tools increase the chance of your call to be right.

There are many technical analysis tools are available in the market.

Best Technical Analysis Tools:

#1 200-day Moving Average:

The 200-day moving average is one of the most popular technical analysis tools which is used by investors to know about the price trend of a stock. This tool takes into account the average closing price of a security of the past 200 days.

How Moving Average works?

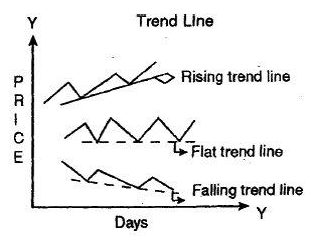

Once the value of moving average has been calculated, you have to simply plat a chart of 200-day moving average price or 50 days, 20 days, a 10-day moving average line based on your choice.

The shorter the time period of days for moving average, the more sensitive it will be to price changes and vice-versa. The stock market is a game of probability, so it depends on which best suits you.

When the price of the stock moves above the moving average line, it’s a buy signal and when the price of the stock goes below the moving average line, it’s a sell signal.

Why Moving Average matters?

The 200-day moving average is dividing line between a healthy company and one which is not. It is also perceived that the percentage of stock above its moving average helps to determine the overall health of the market.

It also helps you to determine profitable entry and exit point from a stock.

Following indicates a buy signal in moving average when:

- Stock price line increases through ‘moving average’ line and line of MA is flattening.

- Stock price line falls below ‘moving average’ line and line of moving average rising.

- Stock price line falls but started rising and is above ‘moving average’ line.

The following indicates a sell signal when:

- Stock price line falls through moving average line and graph of moving average is flattened.

- Stock price line rises above the moving average line but moving average line is falling.

- Stock price line which is rising below the moving average line but again started falling before reaching line of moving average.

#2 Relative strength index (RSI):

Relative strength index is one of the popular technical analysis tools which indicates current and historical strength or weakness of a stock based on the recent closing price.

Identifying a stock to purchase on the basis of the upward trend is not always profitable. But using relative strength index analysis is a good and proven method to buy a stock.

RSI is used to compare the price of all stocks which are followed daily, weekly and monthly basis. It compares the strength rating of all stocks of the previous week to strength rating of the current week.

It shows if a stock is oversold or overbought. Relative strength index is plotted between 0-100. An RSI above 70 indicated that stock is overbought and so you can look to sell your stock.

On the other hand, if RSI is below 30, it indicates a stock is oversold and you can buy that stock.

Here, overbought means stock movement of price to the upside; and oversold means movement of stock to the downside. When the price reaches these two levels, reversal is possible.

#3 Moving average convergence divergence (MACD):

MACD is a very important technical analysis tool.

This tool is used to identifying the moving average of the new trend, which indicates whether it is a bullish or bearish trend. It reveals the changes in the duration of trend, momentum, strength and direction in a stock’s price.

We do it to know the trend because our main motive is to get profit by identifying the trend of the stock.

You can see three numbers on the Moving average convergence divergence chart.

- First one is that number of periods which are used to calculate faster- moving average.

- The second one is that number of the period which is used to calculate the slower-moving average.

- And the third is that the number of bars which is used to show the difference between faster and slower moving average.

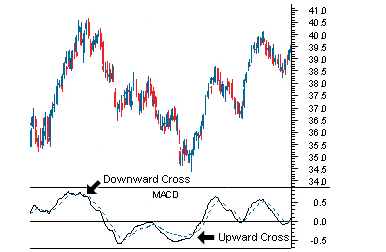

MACD is calculated by subtracting the 26- day exponential moving average (EMA) to 12- day EMA. Whereas, 9-day EMA is called “signal line”, and is plotted on the top of the MACD, signals as a buy and sell trigger.

MACD can be interpreted by using three different methods.

- Crossovers- There are multiple ways to use MACD technique, one of the ways is to watch for the last line to cross the slow line which indicates a shift in momentum. When the MACD line goes below the signal line, it indicates a bearish situation and time to sell. While the MACD line goes above the signal line, it indicates a bullish situation and it’s time to buy.

- Divergence– When the security price diverges from the MACD line, it indicates an end of a current trend. For example, if the security price is rising and the MACD line is diverging, it means stock price rising trend is about to end. And, if the MACD indicator is raising and stock price is falling, means the very soon bullish trend will start.

This tool is normally used with other technical analysis tools in order to find an opportunity. - Dramatic rise – This refers to the situation when MACD rises dramatically- means shorter moving average comes away from longer moving average. It indicates that a stock is overbought and will soon come to the normal position.

This analysis is also combined with other technical analysis tools by the market players to verify the condition of overbought and oversold.

#4 Support and resistance:

You may have heard about support and resistance in the stock market. Many technical analysts tell about this concept.

Support and resistance are two concepts of technical analysis tools, in which the price of stock tend to stop and reverse at a certain predetermined level. Here, buying pressure is more than the selling pressure.

You can use support as stop-loss when a stock is trading near the support level.

As you know stock prices move in a zig-zag way and forms highs and lows. A Resistance is that level which is plotted at a daily low level. And resistance is plotted at a daily high level.

At this level, traders are willing to sell; expecting that price of the stock will not increase anymore. When a stock trades near its resistance level, you can sell your position, by keeping the resistance line as stop loss.

How to Determine the Importance of support and resistance?

There are two important way to determine the importance of support and resistance

- Greater the importance, if greater the volume of trade at the support and resistance level.

- If more the number of times a stock price halts and bounce back from a particular price, more will be the importance of its support and resistance.

#5 Stochastic Oscillator:

It is another well known technical analysis tools, which is an indicator of stock price momentum. According to the stochastic oscillator, a stock’s closing price tends to trade at the higher side of stock’s price action.

Here, price action is the prices of a stock traded throughout the daily session.

Example: If a stock opened at a price of $12, stocks low is $6 and stock’s high is $14.

Then, the price action is between day’s high and low i.e. ($14-$6) = $8. And if the stock is in an upward trend cycle, the closing price of the stock will be at or near the higher side of the trading session.

The stochastic oscillator has become a favourite analysis tool of some of the technicians because of its accuracy. New analysts can also easily perceive it. Also, it helps you to make the right decision of entry and exit on your holdings.

#6 Aroon indicator:

Aroon indicator is a technical analysis tool which is used to identify the new trend of a stock or whether the stock is in trend and what is the magnitude of that trend. This tool is also helpful in identifying when the trend of a stock is likely to begin.

The Aroon indicator comprised of two lines:

- An Aroon-up line – It measures the strength of the uptrend of a stock. A stock is considered to be in an uptrend when the Aroon-up line is above 70 and Aroon-down line.

- An Aroon-down line – It measures the strength of the downward trend of a stock. The stock is considered to be in a downtrend when the Aroon downline is above 70 and above the Aroon-up line.

Both Aroon-up and Aroon-down line fluctuates between 0 and 100. If the value is close to 100, indicates a stronger trend and if the value is close to 0 indicates a weaker trend.

The main assumption of this tool is that the price of a stock will close at a record high in an uptrend, and record lows in the downtrend.

#7 Average directional index (ADI)

This is a tool to measure the strength of a stock’s trend. When the trend of a stock is strong, it reduces the chance of risk and increases the chance of gain.

It can help you to determine whether the trend of a particular stock is strong or not. On the basis of which you can make buy or sell decision. And in many cases the trend is ultimate. ADI does not indicate any direction, whether it is up-trend or downtrend.

It is believed that the trend is strong when ADX is above 25, and there is no trend when the ADX falls below 20.

Technical Analysis Books

Now the use of all the above tools requires in-depth knowledge and understanding. For a beginner trader, it is sometimes difficult to know the practical importance of each.

To make it simpler and easier for them, it is therefore important to gain some sort of understanding and for this, they can refer to books.

No doubt, books are a real friend for everyone and make it easier for all to learn things.

So, if you are a beginner and want to gain the right and complete knowledge and understanding of the stock market, then here are some of the tops picks that you can refer to as per your need.

| Technical Analysis Books | |

| Book | Author |

| Getting Started in Technical Analysis | Jack Schwager |

| Technical Analysis Explained | Martin J. Pring |

| Technical Analysis for Dummies | Barbara Rockefeller |

| Trading and Technical Analysis Course | Mandar Jamsandekar |

| Technical Analysis of the Indian Stock Market | Shriram Nerlekar |

Technical Analysis Tools Summary

So, if you are looking for the simplest way of how to do technical analysis of stocks than here is summary of steps to be followed:

- The 200-day moving average is a technical analysis tool which is used to identify trend direction of stock on the basis of the price of the 200-day moving average.

- Relative strength index (RSI) measures the strength of recent profit or loss to measure the speed of price movement over a particular period.

- MACD signal both the momentum and trend of a stock price.

- Support and resistance indicate that point where security stops and reverses at predetermined stock’s price level.

- Stochastic oscillator displays the location of the close compared to high or low of the stock price over a defined number of periods.

- Aroon indicator is used to measure the magnitude of a trend or a stock is in trend or not.

- The average directional index measures the strength and momentum of an existing trend of price.

In case you are looking to start trading in the stock market, just fill in some basic details in the form below.

A callback will be arranged for you:

More on Share Market Education:

Fundamentals are useful.

I want to learn impartentent fundamentals for both Mcx and Equity.