Motilal Oswal Review

List of Stock Brokers Reviews:

Motilal Oswal Securities Ltd (MOSL) was incorporated back in the year 1987 and is one of the oldest stock broking firms in India.

It is one of the leading full-service stockbrokers in India and is known for its trading applications, portfolio management services, and quick customer support. Motilal Oswal Commodity is one of the best services they provide to its clients.

Let’s have a detailed look at the different values it provides to its respective clients and see whether this broker is good for you or not.

What Is Motilal Oswal?

https://www.youtube.com/watch?v=zvTCTp0ozfw

Motilal Oswal Securities Ltd. or MOSL was founded by Mr. Motilal Oswal and Mr. Raamdeo Agarwal. The Full-service broker is a Depository Participant of both CDSL and NSDL.

Motilal Oswal is a SEBI registered stockbroker and a listed member of NSE (National Stock Exchange) as well as BSE (Bombay Stock Exchange).

MOSL group extends the following services to its customers:

- Share Market

- Motilal Oswal Wealth Management services

- Retail Broking and Distribution

- Institutional Broking

- Asset Management

- Investment Banking

- Home Finance

- Private Equity

By opening an account with the stockbroker, a trader is allowed the opportunity to trade and invest across different financial instruments.

The investment options are mentioned in this Motilal Oswal review:

Motilal Oswal has seen organic as well as inorganic growth in the years of its existence. In 2006, it acquired a south Indian brokerage firm – Peninsular Capital Markets.

While in 2010, it started dealing with mutual funds after getting approval from SEBI (Securities & Exchange Board of India).

Today, the group has a presence in 2200 locations through its sub-broker and franchise network to go along with around 1 million customers.

Motilal Oswal Securities has had its focus on institutional broking but of late it has been gradually pivoting towards full-service retail stockbroking.

As per the latest numbers from 2020, Motilal Oswal broker has 4,48,808 active clients (numbers from the National Stock Exchange of India or NSE) across 2000+ different geographies of the country and outside (with its NRI services).

Furthermore, as per research strength is concerned, this full-service stockbroker has decent visibility and prominence with its team of 40+ research experts.

Raamdeo Agarwal, Director

Motilal Oswal Trading App

Motilal Oswal Trading app is another advantage of opening an account with the stockbroker.

This full-service stockbroker offers multiple trading platforms across various devices offering all sorts of usable features which simplify the Motilal Oswal trading experience.

In this detailed Motilal Oswal review, we will talk at length about all the Motilal Oswal Trading software.

These platforms help traders set up a Demat account, keep a track of the market as well as execute trades when the right opportunity arrives.

Here are the full details of each and every Motilal Oswal trading platform:

Motilal Oswal Desktop Application

If you are looking for super-fast execution of trades, then the EXE based Motilal Oswal desktop application is the right solution for you.

This application needs to be downloaded from their website and then installed on your desktop or laptop to get the Motilal Oswal Login page before you start trading.

Here are some of the screenshots of the Motilal Oswal desktop app:

Some of the features of Motilal Oswal desktop application include:

- Options Strategy Builder – Traders can choose from a variety of options strategies

- F&O Analytics – Get extensive market information like gainers/losers, most active stocks, top events, news, and much more across asset classes integrated with the trading portal.

- Technical Indicators – The app has technical indicators and charts that will help traders evaluate market depth.

- Research Reports – Traders get access to over 30,000 research reports within the app. Research reports and recommendations for days, weeks, months, years.

- Trade Ideas – Trade Guide Signal to auto-generate buying and selling ideas

Motilal Oswal trading terminal is known for good speed and decent user experience but at the same time, is a little bulky as well. Thus, to attain a consistent rich trading experience, make sure your computer or laptop configuration is good enough.

Apart from this application, you can also choose to use Motilal Oswal TGS for an advanced trading experience with the help of AI-driven features.

Motilal Oswal Mobile App

The mobile and tablet app is the need of the hour. Traders and investors need real-time information on the move. This need can be fulfilled through Motilal Oswal Mobile App.

Mobile apps such as Motilal Oswal Orion Lite App deliver on that front.

Motilal Oswal Mobile App has the following features:

- Watchlists – Multi-asset watch lists with real-time quotes and advanced charts

- Market Screeners – The app has 19 market screeners that ensure a trader never misses out on trading opportunities.

- News – Users can get access to all the latest events, news of various stocks, companies, sectors.

- Trading Reports – Users can access these reports to refer to their trading activities and make better trading decisions

- Portfolio Monitoring Tools – Real-time portfolio monitoring tools

- Motilal Oswal Fund Transfer – Funds transfer allowed across more than 60 banks

- Secure Platform – Secure mobile trading experience with a one-time login feature

- Motilal Oswal Stop Loss Order – This feature enables the trader to minimize the risk while price fluctuation by limiting the amount fixed for stop loss.

Here are some of the screenshots of the Motilal Oswal online trading mobile app:

At the same time, there are a couple of concerns with Motilal Oswal mobile trading app:

- A relatively limited number of features

- Few cases observed where the data feed was delayed

Here are the detailed stats of the app from the Google Play Store:

MO Trader App Number of Installs 10L+ Mobile App Size 13MB Technical Indicators 80+ Chart Types 5 Review

Motilal Oswal SmartWatch App

Going a step further than just offering mobile and desktop apps, the stockbroker came up with a Motilal Oswal SmartWatch app that allows you a multitude of features.

Like a watch, a trader wears this device on his or her hand and gets access to all sorts of notifications.

Here are the Motilal Oswal SmartWatch App features:

- Notifications – Traders get all market updates through instant notifications

- Market Update – Instant information on global indices, market top losers, and gainers

- Portfolio – Traders can view their portfolio across asset classes

- Check Margin – This feature allows traders to check Motilal Oswal margin in both cash & commodities segment

- Position Update – Get updates on open positions.

Here are the screenshots of the Motilal Oswal smartwatch app:

Motilal Oswal Trade

MO Trader Web is a web-based trading platform for users who like to access browser-based applications. Some of the key features of the web portal include:

- Power Trade – Traders can place a buy or sell order through just a single click

- Bulk Order – Traders can save orders and later execute them all at the same time

- Price Alert – Set price alerts at price levels. This feature ensures traders never miss out on an opportunity

- One View Dashboard – Gives a quick snapshot of the account in a single view including cash balance, positions, Order Status, portfolio performance across timelines, and Market data.

- Mutual Funds – Provides flexibility of selecting the Mutual Funds one wishes to purchase or the option to choose from expert recommendations.

Some of the screenshots of the web trading platform of Motilal Oswal broker :

Some of the concerns with this web-based trading application include:

- User experience, especially navigation across different features can be improved

- The web application is not responsive in nature and in fact, it is pretty tough to use this application on any mobile device.

Motilal Oswal Charges

There are multiple types of Motilal Oswal trading charges that you, as a client, are supposed to pay. This includes Account opening, maintenance charges, brokerage, transaction charges, stamp duty, taxes etc.

Motilal Oswal Account Opening Charges

For opening an account, here are the initial charges a customer has to pay. Motilal Oswal Account Opening Charges include – Trading account opening and Demat AMC charges.

One of the major advantages of having an account with Motilal Oswal, a trader can set up a Motilal Oswal Free Demat account. In addition, the broker doesn’t charge any trading account AMC charges.

Motilal Oswal Account Opening Charges Trading Account Opening Charges (One Time) ₹1000 Trading Annual maintenance charges (AMC) ₹0 Demat Account Opening Charges (One Time) ₹0 Demat Account Annual Maintenance Charges (AMC) ₹441

To open an account, you need to pay a minimum of ₹25,000 as an initial deposit into your Motilal Oswal Trading Account and demat account.

After the process of Motilal Oswal Account Opening, you can further refer to Motilal Oswal AMC Charges.

Motilal Oswal Brokerage

Motilal Oswal brokerage is negotiable and depends on the amount a client holds in their account.

Motilal Oswal brokerage charges are considered to be expensive in comparison to other brokers. But, they offer a variety of value addition plans which impact the brokerage charges.

You must definitely check out this review on Motilal Oswal Delivery Brokerage as this is one of the most expensive segments for trading in the stock market.

Furthermore, commodity trading is another interesting format of investment. However, in the case of this stockbroker, you would want to learn about Motilal Oswal Commodity brokerage as well before getting into this fascinated format of investment.

However, the default Motilal Oswal brokerage charges list is as follows:

| Motilal Oswal Brokerage | |

| Segment | Brokerage |

| Equity Delivery | 0.50% |

| Equity Intraday | 0.05% |

| Equity Futures | 0.05% |

| Equity Options | ₹100 per lot |

| Currency Futures | ₹20 per lot |

| Currency Options | ₹20 per lot |

| Commodity | 0.05% |

Motilal Oswal Brokerage Plans

Looking at the above pricing, it is certainly one of the expensive stock brokers in India.

Use this Motilal Oswal Brokerage Calculator for complete charges and your profit.

Next, in this Motilal Oswal review, we learn about the various brokerage plans offered by the stockbroker.

There are a couple of Motilal Oswal brokerage plans that clients can choose from. The brokerage charged thereafter depends on the plan a client chooses.

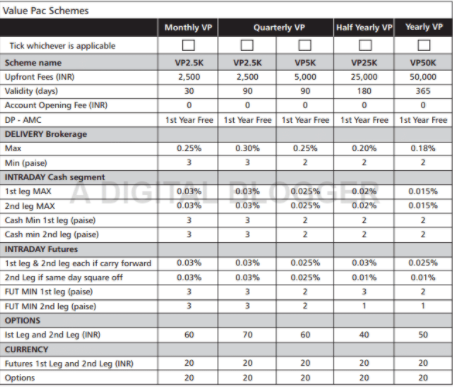

The Value Pack is a subscription-based plan where you need to pay a certain upfront amount based on which the corresponding brokerage charges are applied. The payment made in this plan is NON-Refundable.

How does Motilal Oswal Brokerage Work?

“In the case of full-service stockbrokers, the brokerage is percentage-based. This implies if Motilal Oswal charges you 0.3% for delivery trades and your trading capital is ₹1,00,000 then the brokerage for that particular trade is ₹300.

Thus, it really depends on your trading capital, and based on that the brokerage will be calculated. The minimum brokerage in case of this full-service stockbroker is ₹30 for delivery trades and ₹15 for Intraday trading charges in Motilal Oswal.”

Motilal Oswal Value Pack Plans

Value Pack is an upfront subscription scheme, which provides reasonable discounts on brokerage rates with a defined time period to use it.

With the wide range of Value Packs, based on the Volume of Trade and the Validity period one can enjoy the benefits of placing trades at reduced charges.

Watch Video for a detailed understanding.

Here are the details:

To understand this in detail, let’s take an example. For instance, if you pay ₹2,500 for 1-month, then you will just be paying 0.25% as a brokerage charge based on your trade value.

Similarly, the brokerage percentage drops to 0.18% in case you opt for ₹50,000 for a 1-year plan.

Thus, it really depends on your trading preferences, capital, and trading pattern.

Motilal Oswal Transaction Charges

Apart from the brokerage and account opening fees, there are few miscellaneous charges levied on customers that are also called transaction charges:

Motilal Oswal Transaction Charges Equity Delivery 0.00335% Equity Intraday 0.00325% Equity Futures 0.00200% Equity Options 0.05110% Currency Futures 0.00125% Currency Options 0.04200% Commodity 0.00325%

Motilal Oswal Margin

Traders reluctant to pay the complete purchase price of stocks upfront can avail Motilal Oswal Margin facility. A customer simply needs to provide a defined upfront margin amount at the time of opening the account.

Motilal Oswal broker offers Motilal Oswal Margin Scheme for frequent traders. The brokerage charges in these schemes vary based on the margin amount held by the trader.

| Motilal Oswal Margin | |

| Segment | Brokerage |

| Equity Delivery | Currency Options |

| Equity Intraday | 0.015% to 0.05% |

| Equity Futures | 0.015% to 0.05% |

| Equity Options | ₹25 to ₹100 per lot |

| Currency Futures | ₹20 per lot |

| Currency Options | ₹20 per lot |

| Commodity | 0.015% to 0.05% |

Also, for more information, you can read Motilal Oswal Intraday Margin.

When you use the Motilal Oswal Margin scheme, the brokerage percentage is decided based on your initial deposit. The more the deposit, the less you end up paying as a brokerage percentage.

At the same time, you must certainly negotiate with the executive of the full-service stockbroker. We have seen many instances where clients have saved decent brokerage percentages just by negotiating before opening the account.

Make sure to get everything documented or emailed before you open a demat account with Motilal Oswal. This includes the final brokerage charges/percentage that you will pay across segments and other related charges.

Motilal Oswal Customer Care

Here, in this Motilal Oswal review we learn about the various methods a customer can contact the stockbroker to get their queries resolved.

After the activation of Motilal Oswal demat account the full-service stockbroker provides the following communication channels to their clients:

- Phone

- Offline Branches

- Social Media

With multiple communication channels, the broker offers a reasonable quality of customer service. Their branches are spread across India, thus you can find Motilal Oswal near me branches easily.

The turnaround time is pretty reasonable too, however, the messaging can be improved in terms of personalized communication to clients, generally done through Email or SMS.

Assistance provided through online media or telephone is pretty quick and thus, takes away the importance of offline locations.

Apart from that, Motilal Oswal ChatBot is one of the unique propositions of this stockbroker’s customer support.

“The fundamental and technical research of Motilal Oswal encompasses around 260 companies listed on the stock market coming from 21 different industries.”

Motilal Oswal Research

Motilal Oswal Research is counted among the best research facilities in the Indian market. Motilal Oswal claims to provide more than 30,000 research reports encompassing 260 stocks covering 21 sectors through 40 types of different reports.

Let’s have a look at some of those reports to get an idea about what this broker brings to the table:

Company Reports

These reports talk about the fundamentals of different companies listed on different exchanges of India.

Furthermore, these reports also have mentions of various economic events happening at the state and country levels that can directly or indirectly impact specific sectors and respective company stocks.

It makes sense to keep a passive check on such reports on a regular basis.

Sector Reports

As the name suggests, these types of reports talk at length about different sectors, what is happening in these sectors, different government policies, market dynamics etc.

Reading these reports may help you to understand what stocks may get impacted in the short as well as in the long-term at both fundamental and technical levels.

Thematic Reports

Thematic reports are theme-based research outputs coming from some of the latest events across industries and business domains.

For example – If ‘Swachh Bharat Abhiyaan’ was introduced, these reports mentioned the different sectors that will get impacted positively or negatively due to such an initiative.

Furthermore, there is a discussion on the different companies as well that would get the maximum impact.

Market Analysis Reports

These reports encompass multiple types of reports that get published on a daily basis. Such reports include (but not limited to) Market round-up, currency report etc.

People looking to place intraday trades may find these reports helpful since these can prepare the trader for trading decisions to be taken in the day.

How to Open an Account?

Enter Your details here to get a callback.

Next Steps:

Post this call, You need to provide a few documents to start your account opening process. The Motilal Oswal Account Opening Documents required are as follows:

- ID Proof

- An address proof

- Bank statement for the last 6 months, canceled cheque

- Passport-sized photograph

- AMC fees (if applicable)

- Trading Account cheque

Once you are done with this, your account gets opened within 2-3 business days.

For more information, you can check this detailed review of documents required for demat account.

Motilal Oswal Membership Information

Here is the membership information of the broker with different exchanges and intermediate parties:

Entity Membership ID NSE (Capital Markets) INB231041238 NSE (Futures & Options) INF231041238 BSE (Capital Markets) INB011041257 BSE (Futures & Options) INF011041257 MSEI INB261041231 CDSL IN-DP-16-2015 NSDL IN-DP-NSDL-152-2000 PMS INP000000670 Registered Address Motilal Oswal Tower, Rahimtullah Sayani Road, Opposite Parel ST Depot, Prabhadevi, Mumbai-400025

The details can be verified from the corresponding websites of the exchanges.

Motilal Oswal Advantages

At the same time, you get the following advantages while trading through Motilal Oswal:

- Trader Friendly Schemes – Some of the schemes are trader friendly in terms of brokerage for long-term

- Trading Platforms – An array of trading platforms across devices with high performance and speed

- Diverse Range of Products – Motilal Oswal Products are being offered to meet different kinds of requirements you may have.

- Phygital Investing Model: The broker has come up with the Motilal Oswal phygital investing model where one can reap the benefit of physical advisors along with digital advisory services.

- Customer Support – One of the biggest benefits of Motilal Oswal broker is their quick customer support and assistance.

- Margin – The stockbroker offers reasonable margin rates.

- One of the best portfolio management service providers in the country among all the top stockbrokers.

- Trusted Name – One of the oldest names in the industry, so the trust factor is there.

- Funds Transfer Facility – Funds transfer with more than 60 banks allowed

- Brokerage Plans – The stockbroker offers multiple brokerage plans to its customers.

- Motilal Oswal Call and Trade – Traders or investors can place trades through Call and Trade services at no additional cost

If you like your trading experience here, then you may choose to use the Motilal Oswal Refer and Earn offer and make decent money on each account you refer to this stockbroker.

Motilal Oswal Disadvantages

Here are some of the concerns if you become a client of Motilal Oswal:

- Irregular Brokerage – Complaints around brokerage promised and brokerage charges have been raised in the recent past

- Advisory Services – Recommendation tips are not that promising as some of the other full-service stockbrokers

- Hidden Charges -Make sure you understand some of the hidden charges, that you might not be explained at the onset.

“Motilal Oswal has received around 21 complaints for the financial year 2020-21 at BSE and NSE.”

Conclusion

“Motilal Oswal is a reasonable option as a stockbroker for both traders and investors. So whether you are looking to make short-term profits or long-term investments.

Established in the year 1987, Motilal Oswal is among the earliest stockbrokers in the country and enjoys a trust factor among traders. This is backed by the fact that the broker has over 4.4 Lakh active clients

Motilal Oswal can certainly be considered one of the best when it comes to research. However, it does need to come clear in its Pricing.

Talking of the negatives, the most glaring are their brokerage plans, which can be misleading and there have been cases reported around some hidden charges at a time.

Thus, a little caution from the customer’s point of view is suggested.

Other than that, the trading platforms across devices are good to go along with better than average customer service.

To finish the Motilal Oswal review, we would say that the broker gets a big up from our side and the merits outweigh the concerns associated with the brand.”

Motilal Oswal FAQs:

Here is a quick look at some of the most frequently asked questions about this full-service stockbroker:

- What are the account opening charges at Motilal Oswal?

To open an account with this full-service stockbroker, you are required to pay ₹1000 for the trading account, while the demat account has no cost attached to it.

2. What is the research quality at Motilal Oswal?

The full-service stockbroker provides you with decent research reports, recommendations and trading calls through Email, SMS, Whatsapp to go along with the Motilal Oswal research section within the trading platforms offered by the broker.

It becomes much easier to make quick judgments by accessing the reports on the platform.

As far as accuracy is concerned, the broker provides better than Industry average quality to its clients.

3. Does Motilal Oswal allow me to invest in Mutual funds and IPOs?

Yes, the broker offers multiple trading and investment products including Mutual funds and IPO investments as well.

4. How many clients do Motilal Oswal have and how many of those are active ones?

As of June 2017, the full-service stockbroker has a client base of over 9,000,000 with 2,07,194 active clients.

5. What is Motilal Oswal Uppermost?

This is a mobile app by the full-service stockbroker offered to its partners, sub-brokers and franchises where the users can get access to its own client data, the corresponding brokerage generated and other details specific to the partner’s business.

6. How much is Motilal Oswal AMC (Annual Maintenance Charges)?

To maintain your Demat account with the full-service stockbroker, you are required to pay ₹400 on a yearly basis. Trading account AMC or annual maintenance charges are nil.

7. How is Motilal Oswal’s mobile app?

Although the full-service stockbroker offers multiple trading platforms to its clients across devices. As far as the mobile app is concerned, it is good to use as far as performance and user experience are concerned.

However, there are few issues related to the number of features or usability of the application. As of now, it is certainly a recommended application for you to use for trading.

8. How to Trade in Motilal Oswal?

Trading in Motilal Oswal is simple, you just need to have a demat account with the broker for that you can refer to the Motilal Oswal Account Opening form below and proper guidance will be given to you.

9. Can I place AMO (After Market Hour Orders) with the broker?

Yes, you can place aftermarket orders i.e. order placing is allowed even after the market is closed.

Also, Check Out these detailed comparisons of Motilal Oswal Vs Other stockbrokers:

Also, Check Out these detailed comparisons of Motilal Oswal Vs Other stockbrokers:

Do you want to open a Demat Account? Please refer to the below form

Know more about Motilal Oswal

“Recommendation tips are not promising as compared to other brokers”

Which broker do provide the best recommendations?

Please check this link: https://www.adigitalblogger.com/trading/best-stock-brokers-research-tips-india/

Motilal Oswal Research calls are very poor, it is coming around 20-30%. so it is better that open trading account from any discount broker and buy research calls from sebi research analyst.

Motilal Oswal Securities Ltd is the worst brokerage firm.Very poor advisory service.I had lost almost 40-50 % in last 4 months only because of poor advisory.

All the calls provided them are so worst that it will happen in the reverse.

The staff work for there own earning (commission) & not for clients good.

I don’t see a single reason to recommend MOSL to anyone.

very poor reco, my portfolio depleted 20% in last 1 year with their recommendations.