Kotak Securities Brokerage

Check All Brokerage Reviews

Every investor is often concerned about the brokerage that will be charged. If you want to know about the Kotak Securities brokerage, then you have reached the right place.

Being a full-service broker, it is often thought that the levied brokerage charges will be comparatively high. But, in the case of Kotak Securities, you can pick and choose the plans according to your needs and pocket.

So, you get the chance of availing the services of a full-service broker but at better pricing. Let us unveil all the Kotak Securities brokerage details in the upcoming sections.

Kotak Securities Brokerage Charges

Brokerage charges are levied by the stockbrokers on every executed order. When you successfully complete a trade, a minor chunk of the fees goes to the broker. In the case of full-service brokers, the brokerage is said to be comparatively high.

But Kotak Securities claims to offer the lowest brokerage charges in India. So, is Kotak Securities a discount broker?

Well, it is not only the brokerage that describes a type of stockbroker. There are many products and services that need to be considered. Here, let’s begin by understanding the detail of Kotak Securities brokerage.

Let us now look at what are the brokerage charges of Kotak securities for different segments.

Kotak Securities Delivery Brokerage Charges

Many beginners opt for long-term investment and thus it is essential for them to know about the delivery brokerage fees. The brokerage for the equity delivery segment varies according to the plan.

| Kotak Securities Delivery Brokerage Charges | |

| Segment | Brokerage |

| Equity Delivery | 0.25% |

| Equity Futures Delivery | ₹20 per order |

| Equity Options Delivery | ₹20 per order |

| Currency F&O Delivery | ₹20 per order |

| Commodity F&O Delivery | 0.25% |

Let us understand this with the help of an example. Rahul did a trade of ₹10,000. So there will be different brokerage on different plans.

- In the fixed brokerage plan, he will be charged 0.5% of 10,000 = ₹50

- In the Trade Free Plan, the brokerage will be 0.25% of 10,000= ₹25

Kotak Securities Intraday Charges

The broker comes with an exclusive benefit and offers for intraday traders. The Trade Free Plan offers relaxation to day traders from paying any fees and thus you can trade without paying any brokerage to the broker.

The complete details of the brokerage are tabulated below:

| Kotak Securities Intraday Brokerage | Brokerage Charges |

| Intraday Trading Charges | Zero |

Just to stick to the regulatory measures, a minimal amount of 1 paisa per scrip is charged on intraday trading.

Kotak Commodity Brokerage Charges

Kotak securities gives you a chance to trade in commodities as well. The Kotak commodity brokerage charges are listed as follows:

| Kotak Commodity Brokerage Charges | |

| Trading Segment | Brokerage |

| Commodity F&O Intraday | Zero |

| Commodity F&O Delivery | 0.25% |

Kotak Securities Currency Brokerage Charges

With the use of various strategies, a lot of traders invest in different forms of currencies. The brokerage charges of trading in the different currencies are as given below.

| Kotak Securities Currency Brokerage Charges | |

| Segment | Brokerage Charges |

| Currency Futures Delivery | ₹20 per order |

| Currency Options Delivery | ₹20 per lot |

| Currency Futures Intraday | Zero |

| Currency Options Intraday |

Kotak Securities Option Brokerage

The option is a form of derivatives and used to minimize the risk. A lot of people trade in options contracts. The Kotak Securities derivatives brokerage differs in such cases. The Kotak Securities brokerage charges for options are:

| Kotak Securities Option Brokerage | |

| Segment | Brokerage |

| Equity Options Intraday | ₹0 |

| Currency Options Intraday | ₹15 per lot |

| Commodity Options Intraday | ₹75 per lot |

| Equity Options Delivery | ₹20 per order |

| Currency Options Delivery | |

| Commodity Options Delivery | 0.25% |

Kotak Securities Futures Brokerage

The brokerage charges of trading in futures differ from the others. The Kotak Securities futures brokerage is tabulated below:

| Kotak Securities Futures Brokerage | |

| Segment | Brokerage |

| Equity Futures | ₹20 per order |

| Currency Futures Delivery | ₹20 per order |

| Currency Options Delivery | 0.039% |

| Commodity Futures Delivery | 0.25% |

| Commodity Options Delivery |

Looking at the brokerage fees it can be said that even though the broker is bank-based but offer benefits to traders by allowing the traders to trade for Free in intraday. Along with this, there are many more benefits that makes it relatively better than many other full-service stockbrokers.

You can grab a complete understanding by checking the Kotak Securities vs Angel Broking comparison.

Kotak Securities Brokerage Plans

Imagine sitting at a restaurant with all your friends and ordering only non-vegetarian food, knowing that some of them don’t consume it. Sounds biased right?

Similar is the case with traders. Why should someone pick the same plan when their segments and needs are different? To make it easier, Kotak Securities has various brokerage plans to meet everybody’s needs. The plans are as follows.

Kotak Trade Free Plan

There are some people who often complain about the high brokerage that is charged by the full-service brokers. But that problem is solved with the Kotak trade free plan.

On activation of the plan, you will be charged a ₹0 brokerage for intraday trading. Apart from this, you will be charged a minimum amount on the other segments.

| Kotak Securities Trade Free Plan Charges | Standard Plan |

| Segment | Charges |

| Equity Delivery | 0.25% |

| Equity Intraday | Free |

| Equity Futures | ₹20 per order |

| Equity Options | ₹20 per order |

| Currency Futures Delivery | ₹20 per order |

| Currency Options Delivery | ₹20 per order |

| Currency Futures Intraday | Zero |

| Currency Options Intraday | Zero |

| Commodity Futures Delivery | 0.25% |

| Commodity Options Delivery | 0.25% |

| Commodity Futures Intraday | Zero |

| Commodity Futures Intraday | Zero |

Kotak Securities Zero Brokerage Plan

Along with Trade Free plan, Kotak Securities comes with alluring offers for traders who are less than 30 years of age. The Zero brokerage plan allows traders to trade at zero brokerage across segments.

To activate this plan, one must be less than 30 years of age and need to pay one-time subscription charges of Rs 499. Not only this, but the user can avail of the benefit and free access to Elearnmarkets and Stockedge courses.

Check the complete details and avail of the offer now and start trading for Free.

Kotak FIT Plan

Free intraday trading plan or Kotak FIT plan, is an ideal deal for traders who are focused only on intraday trading. You will have to pay no brokerage for your intraday trade irrespective of the size, volume, or segment of your trade.

If you are directly connected to Kotak Securities, you can call up customer care and get your plan started. It is only applicable to intraday trading and in the cases of delivery trading, the trader is required to pay the brokerage.

How Does Kotak Securities Charges Brokerage?

Let us understand the concept of brokerage with the help of an example. Suppose there are two friends, Gitansh and Geetika.

Suppose they both executed intraday trading but picked up different plans, then their brokerage will be calculated as follows.

- Gitansh is an intraday trader but has not activated the Trade Free Plan. He executed the trade of ₹1,00,000. Now as per the standard plan he paid a brokerage of 0.039%. Hence, the total brokerage was 0.039% of 1,00,000 = ₹39

- On the other hand, Geetika has opted for the Trade Free Plan and thus executes multiple trades in a day without paying any brokerage fees.

Kotak Securities Brokerage Calculator

Although the brokerage for Intraday trade for Geetika is Zero, some amount is debited from her trading account whenever she executes the trade.

Wondering what are those charges?

Well! Along with the brokerage fees, there are some additional fees charged by the broker. These include,

- Kotak Securities STT charges

- Kotak Securities Transaction charges

- Stamp duty charges

- Kotak Securities DP Charges

- GST

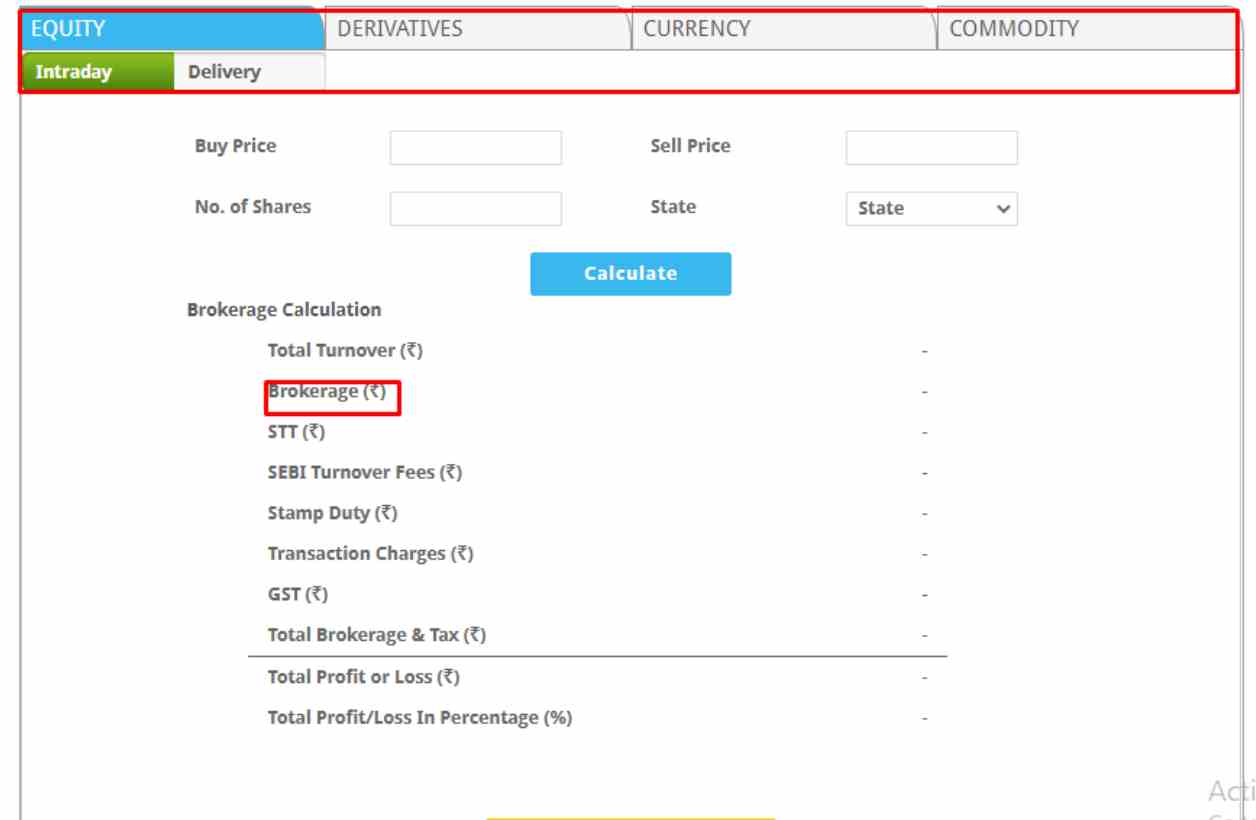

Now, to get an idea of the total charges, Geetika used a brokerage calculator like this:

Conclusion

Kotak Securities brokerage charges as stated above is amongst the least offered as they give you an opportunity to trade absolutely free in intraday. We hope that you have got the understanding of the Kotak securities brokerage charges review now and you won’t miss out on any profitable opportunity.

Still, in case you are looking to get started with stock market trading and need some assistance, ring us in!

Just put in your contact details here and we will arrange a callback for you: