Samco

List of Stock Brokers Reviews:

Samco Securities is one of India’s leading investment technology companies registered with SEBI as a stockbroker, research analyst, and a member of NSE, BSE, MCX, and NCDEX. The company is a depository participant membership of CDSL.

Today, we present a SAMCO review to help you select the best broker for you.

So, let’s try to answer a fundamental question – What SAMCO is.

Samco Review

Samco Securities was incorporated by Mr. Jimeet Modi, Founder & CEO of Samco Group in 2015.

As the country’s leading flat-fee brokerage and investment-tech platform, Samco Securities provides retail investors access to sophisticated financial technology and makes their wealth-creation journey simple, informed, and cost-effective.

Samco Securities’ mission is to help every stock market participant consistently outperform the index and achieve their best financial performance.

With customer centricity at Samco’s core, they have implemented a quantitative approach to provide differentiated solutions that empower customers to ace the capital markets by trading & investing in stocks, Equity Derivatives, Currency Derivatives, Commodities, Mutual Funds, and IPO.

Some other broking products provided by SAMCO are:

- Stock SIP: Customers can now choose to invest in stocks through a periodic Systematic Investment Plan (SIP) starting as low as ₹2000/- per month, enabling them to embark on their trading journey.

- MTF CashPlus: Samco’s equity delivery leverage product that allows investors to get up to 4X

- margin against cash in over 400+ stocks for equity delivery trades.

- MTF StockPlus: Allows traders to use these shares as margins after pledging for carry forward

- trades in the NSE F&O & NSE CDS Segments.

- KyaTrade: An innovative platform that instantly identifies and streams a vast array of trading

- and investing ideas, enabling users to capitalize on opportunities from any location and at any time of the day.

- StockBasket: Launched first in India, enables investors to invest in an expert curated basket of quality stocks best suited to their long-term goals.

Samco Founder

Jimeet Vipul Modi is the founder promoter and CEO of the Samco Group which is a leading wealth-tech and investing services platform. The Samco Group operates broadly with 3 lines of business – firstly, Samco Securities, a leading and profitable equity & commodity broker.

Secondly, Samco Asset Management/ Samco MF which is India’s youngest Asset Management Company, and finally Rank MF which offers financial product research, distribution, and wealth management services.

Jimeet Modi, CEO – SAMCO Securities

Jimeet Modi, CEO – SAMCO Securities

As a group, Samco operates with a mission of building products, and solutions and providing services to help investors achieve superior investment returns & financial performance.

Under his leadership, Samco has scaled from over a 10-member+ team in 2015 to over a 550+ member organization in 2023 with revenues scaled to a run rate of over INR 100+ crores per annum during this period. In a short time, Samco’s Equity & Equity-linked assets under management and distribution have crossed INR 1000+ crores.

Jimeet is a Rank Holder Chartered Accountant from the Institute of Chartered Accountants of India & commerce graduate from the University of Mumbai. He is an alumnus of R.A. Poddar College of Commerce and Economics & a CFA (USA). He began his career as a part of the auditing team at Deloitte, where he audited several large corporates like JSW Steel, Cadbury India, Shoppers Stop, DSP Merrill Lynch, etc.

In addition to his impressive educational background, Modi has a successful career spanning over 15+ years, during which he has gained extensive experience in equity research, investment analysis, and technology.

With his unique blend of technical knowledge and business acumen, Modi is well-positioned to continue driving the success of the Samco Group for many years to come.

Samco Mission Ace the Index

Samco Securities has launched the Mission: Ace the Index, a nationwide initiative with the aim of empowering investors & traders to enhance their investment performance and outperform benchmark returns.

The mission is designed to provide participants with the tools, resources, and knowledge they need to succeed in the complex and ever-changing world of investing.

To participate in the Mission, stock market participants can take the pledge to prioritize their investment performance and commit to taking the necessary steps to achieve their financial goals. The pledge covers 3 aspects of prioritizing investment performance & stock market participants have to pledge for any one of them.

The 3 aspects are:

- Strive to outperform the relevant benchmarks by researching and analyzing investment opportunities, managing my portfolio actively, and adapting my strategies to changing market conditions.

- If I am unable or unwilling to manage my portfolio actively, I pledge to outsource my funds to a professional fund manager who has a proven track record of delivering superior returns.

- Invest in an Index ETF that tracks the relevant benchmark to ensure that I am aligned with the market’s overall performance and can benefit from its growth.

Samco provides pledgers with the tools, resources, and knowledge they need to improve their performance in the stock market & consistently ace the index. Stock market participants can take the pledge & access powerful tools, resources, and knowledge by visiting www.acetheindex.com.

Why Mission Ace the Index?

Samco Securities commissioned a one-of-its-kind Indian capital market and investor behavior survey to Nielsen, the global leader in consumer insights, data and analytics firm.

The survey has been done across 10 major cities which include Delhi, Mumbai, Ahmedabad, Bengaluru, Pune, Surat, Kolkata, Hyderabad, Chennai, and Jaipur, focusing on approximately 2,000 investors and traders in the age group 24 – 45 years, the study reveals some interesting findings:

- 68% of stock market participants are unable to generate even the benchmark index returns

- 65% of investors are not even aware of their exact stock market returns

- 77% of investors are not even aware that they consistently need to beat the benchmark indices

- Among the limited 23% of investors who are aware that they need to beat the benchmark indices; more than 50% have no aspiration or idea about on how to outperform the benchmark indices.

- 63% of investors don’t even target or have any plans to beat indices.

This is where Samco believes that they are ready to solve this real-life problem of stock market participants & invites them to join ‘Mission – Ace the Index’, and take the pledge to prioritize investment performance.

Samco urges investors to ace i.e. outperform the relevant benchmark indices by researching and analyzing investment opportunities, managing portfolios actively, and adapting strategies according to evolving market conditions.

Samco Trading Platform

Samco Securities’ mission is to help every stock market participant consistently outperform the indices and achieve their best financial performance.

With customer centricity at Samco’s core, they implement a quantitative approach to provide differentiated solutions that empower their customers in acing the capital markets.

With the launch of the new-gen Samco App, a Capital Resource Planning (CRP) platform, they are now poised to bring tech-enabled, personalized features to help drive customer success.

They understand that every investor’s needs are unique, which is why they offer a comprehensive suite of platforms across their three core businesses of securities, mutual fund distribution, and asset management.

This diversified offering provides a wide range of solutions for their customers to choose from, as they start building their wealth.

New Gen Samco Trading App

A tech-led revolutionary trading app that introduces power-packed features like a personal index, peer comparison, net worth widget & social sharing to improve customers’ efficiency in the stock market.

The key features of the new-gen Samco app are as follows:

- Personal Index: Samco clients can create their own personal index and track their true stock market performance by comparing it against a chosen benchmark index. They cant track their performance on a real-time basis and know whether they are outperforming the benchmark index or underperforming the benchmark index. They can add multiple numbers of benchmark indices as per choice for comparison.

- Net Worth Tracker: The net worth tracker is a unique widget in the new-gen Samco app which gives a real-time movement of clients’ net worth. Samco clients can easily track their net worth movement spread across different segments and efficiently utilize their funds.

- Peer comparison tracker: Samco clients can also compare their personal index performance with their peers at Samco. They can compare it within their category or within the whole Samco universe. This gives them a clear picture of where they stand amongst their peers at Samco.

- Star fund manager: Not only Samco clients can compare their personal index performance with their peers at Samco, but they can also compare their performance with the star seasoned mutual fund managers of different AMCs. They can really check whether they are outperforming or underperforming.

- Advanced watchlist: The advanced watchlist in the new-gen Samco app not only allows clients to add stocks in their watchlist but it also allows them to track their personal index with market movers and gainers of the day. Future & options traders can benefit from the Future OI Build-up widget and FI & DI insights.

- Advanced options trading: Samco clients enjoy no restrictions in selecting the strike prices for option contracts and also leverage their option chain analysis by accessing all the strike prices at one place.

- Margin Trade Funding: The Samco MTF facility helps Samco clients to enjoy up to 4X margin against their cash balance in about 500+ stocks. Also, Samco clients can initiate trades at even Zero balance by getting a margin against their shareholdings.

The Samco mobile is available for free to all customers. You can download StockNote mobile app free from the following app stores:

- Google Play Store

- Apple App Store

Samco Web Trading Platform

Samco web platform is an excellent choice for investors who are looking for a reliable and secure online trading platform. With its comprehensive features and intuitive user interface, investors can easily trade a wide range of financial instruments and make informed trading decisions.

Samco NEST Trader

Samco Nest Trader is a desktop trading application that gives a trader access to a minute-by-minute intraday chart. This is of great utility for intraday trading.

This facility is provided under NEST Plus Charts service. While logging in for the very first time after account opening, the client would be asked to register for the NEST Plus Service.

One needs to enter just their mobile number and their Email ID. This is a one-time registration process and is required only once. The registration can be done later as well. One can also visit the Nest Plus website for registration. Know more about Samco’s desktop trading application.

Samco Mobile App

Along with the desktop terminal and app, the user can reap the benefit of mobile-friendly trade with the high-intuitive and technology-driven mobile app.

You can get all the features and details of shares, market, and other data in its app with the feature of quick buy and sell that makes trading seamless for every trader.

The New Gen Samco App

The new-gen Samco app is the CRP platform/ trading application built by Samco Securities and powered by MyDEX Technology. The trading application is built on the PerforMAX strategy to help Samco clients to track & improve their stock market performance. The key features of the new-gen Samco app are as follows:

- Personal Index: Samco clients can create their own personal index and track their true stock market performance by comparing it against a chosen benchmark index. They cant track their performance on a real-time basis and know whether they are outperforming the benchmark index or underperforming the benchmark index. They can add multiple numbers of benchmark indices as per choice for comparison.

- Net Worth Tracker: The net worth tracker is a unique widget in the new-gen Samco app which gives a real-time movement of clients’ net worth. Samco clients can easily track their net worth movement spread across different segments and efficiently utilize their funds.

- Peer comparison tracker: Samco clients can also compare their personal index performance with their peers at Samco. They can compare it within their category or within the whole Samco universe. This gives them a clear picture of where they stand amongst their peers at Samco.

- Star fund manager: Not only Samco clients can compare their personal index performance with their peers at Samco, but they can also compare their performance with the star seasoned mutual fund managers of different AMCs. They can really check whether they are outperforming or underperforming.

- Advanced watchlist: The advanced watchlist in the new-gen Samco app not only allows clients to add stocks to their watchlist but it also allows them to track their personal index with market movers and gainers of the day. Future & options traders can benefit from the Future OI Build-up widget and FI & DI insights.

- Advanced options trading: Samco clients enjoy no restrictions in selecting the strike prices for option contracts and also leverage their option chain analysis by accessing all the strike prices in one place.

- Margin Trade Funding: The Samco MTF facility helps Samco clients to enjoy up to 4X margin against their cash balance in about 500+ stocks. Also, Samco clients can initiate trades at even Zero balance by getting a margin against their shareholdings.

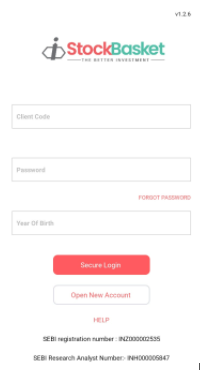

Samco Stock Basket

SAMCO Stock Basket is a responsive SAMCO trading platform that can be accessed directly through a mobile application. It is available on Android and iOS devices.

Clients have to enter a valid username and password and start trading from anywhere, anytime.

It comes loaded with all kinds of attractive features and looks. It has a fantastic feature of getting suggestions about a basket of stocks recommended by the experts.

These stock baskets are to be chosen by the trader as per his investment goals. The login page is as shown below:

Although this mobile-application adds many brownie points to the SAMCO review based on the idea behind the trading platform, it fails in the implementation aspect.

SAMCO seems to have a quantitative approach when it comes to trading platforms. Although they have provided multiple trading platforms, quality-wise, there are quite a few compromises that can be observed.

The Bigger concern is, there are minimal updates done on these trading platforms. These small problems add up to bringing the ratings in the SAMCO review down.

Samco Margin Trade Funding Products

Along with the investment products, Samco offers leverage benefits to its clients through its multiple-margin funding products.

Here is the list of margin products:

- MTF CashPlus

- MTF StockPlus

It gives the benefit to investors to invest in quantity even with the limited available fund in the trading account. Here is the detail of each product.

MTF CashPlus

CashPlus unlocks up to 4X margin to buy shares in delivery against your cash balance. Open a Samco account and get the highest delivery leverage in 500+ stocks

Samco offers a host of leverage products to investors and traders, one of them is CashPlus. CashPlus enhances client’s equity delivery buying leverage..

CashPlus is Samco’s equity delivery leverage product that allows investors to get up to 4X margin against cash in over 400+ stocks for equity delivery trades. In simple terms, if you have Rs.1,00,000 cash balance in your Samco ledger account, you can buy stocks in delivery for up to Rs. 4,00,000 with a CashPlus subscription.

MTF StockPlus

StockPlus is a complete margin-against-shares and mutual funds product that provides trading limits against your shareholdings for intraday and positional trading in the equity derivatives and currency derivatives segment.

Get trading limits against your shareholdings and trade across F&O and cash segments. Open a Samco account and initiate trades even at zero cash balance with Samco StockPlus.

With Samco StockPlus, you can get margins against your shareholdings for intraday and positional trades.

You can initiate trades even if the cash available in your trading account is ZERO! There’s no requirement to maintain any cash/collateral ratios.

StockPlus empowers you to trade at zero cash balance.

Samco Mutual Fund

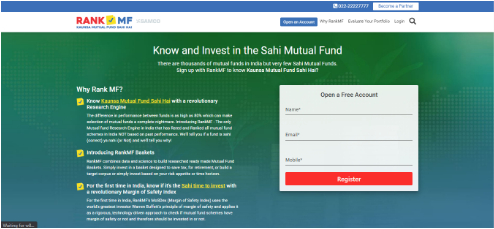

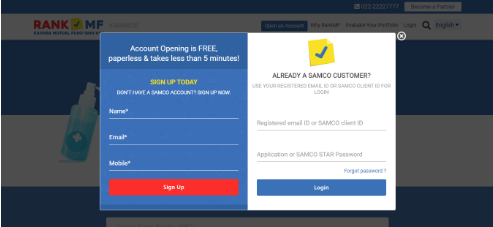

SAMCO Rank MF is the portal for investing in the mutual fund segment. It is accessible in both formats – Mobile (Rank MF App) and Web (Rank MF Web).

The portal extends qualitative research on the mutual funds available in the market.

It assists the trader or investor in choosing the most suitable mutual fund from the sea of choices. The preferability score of the mutual funds is decided by judging them on multiple parameters.

The portal is programmed to rate mutual funds out of 5 stars. These ratings are Rank MFs proprietary and are subject to change without any intimation. In-house experts provide suggestions and ratings.

The account opening page and the login page look like this:

SAMCO FLEXI CAP FUND

Samco Flexi Cap Fund will invest in 25 Hexashield-tested efficient companies from India & across the globe at an efficient price, maintaining an efficient portfolio turnover & cost to generate a superior risk-adjusted return for investors over the long term.

SAMCO ELSS TAX SAVER FUND

Samco ELSS Tax Saver Fund is an open-ended Equity Linked Saving Scheme with a statutory lock-in of 3 years and tax benefit. It aims to provide you the potential return of investing in high-quality mid and small companies with the benefit of tax savings.

SAMCO ELSS TAX SAVER FUND

Samco ELSS Tax Saver Fund is an open-ended Equity Linked Saving Scheme with a statutory lock-in of 3 years and tax benefit. It aims to provide you the potential return of investing in high-quality mid and small companies with the benefit of tax savings.

Samco Back Office

SAMCO Star is the discount broker’s back-office system where most of the administrative tasks related to your trading are conducted. The accessibility to a back-office increases the way a customer provides the SAMCO Review.

The trader has to enter the SAMCO back office login credentials to access the portal. This system allows you to take care of:

- Current funds

- Holdings and positions

- Ledger balances

- Profit/Loss in your trade book reports

- Equity Assets Valuation

- Commodity Assets Valuation

Samco Customer Care

The discount broker can be reached out to by the clients through various communication channels. They are as follows:

- SAMCO Helpline – 022-2222-7777, 022-4503-0450

- Raise a Ticket on the website.

- Social Media (Facebook, Twitter, Youtube, LinkedIn, and Instagram)

When it comes to customer service, the thing with SAMCO is that they are very sales-like in their discussion mode. However, customer service primarily aims to help out an existing client base when they get stuck in any specific aspect.

If the broker is looking to provide any value to its clients through SAMCO support, it needs to look at some aspects very closely as they matter a lot in the SAMCO review. These aspects are:

- Train its customer executives team and make them skillful enough to deal with clients coming with different queries.

- Quicken up the turnaround time for the resolution provided to the client.

Once these primary areas get figured out by this discount broker, clients’ outlook may change.

“SAMCO introduced ITL (Indian Trading League), in lines to Zerodha‘s 60-day challenge, with Kapil Dev to bring in organic popularity. But what matters to clients is transparency, value for money service, and decent trading platforms.”

Samco Fund Transfer

There are three ways to transfer funds to your trading account in SAMCO. The more options they extend, the better ratings are received in the SAMCO review.

The fund transfer methods are:

- Payment Gateway

- NEFT/RTGS

- Cheque

- UPI (Unified Payments Interface)

- Through Stock Note Web

The broker requires the clients to either use the back-office or submit a payout request through the trading platforms. The fund’s transfer happens in 2-3 days (although it is claimed that it happens the same day).

Samco Charges

In pricing, a client needs to pay the following charges during trading:

- Account Opening Charges

- The brokerage of the stockbroker

- Transaction Charges of the exchange

- Goods and Services Tax

- SEBI Charges

- STT

- CM Charges

- Stamp Duty Charge (varies from state to state)

“The minimum initial deposit you need to provide for account opening is ₹25,000.”

Samco Securities Account Opening Charges

Samco Securities offers a fully digital account opening facility to its customers. It is a simple, instant, and 100% paperless process. The account opening at Samco is free with zero maintenance charges for the first year which means a Samco customer will not have to pay the AMC charges for the first year. Detailed account opening and AMC charges are listed below.

| Samco Demat Account Charges | |

| Trading Account Opening Charges | ₹0 |

| Trading Account Maintenance Charges (AMC) | ₹400 from second year onwards |

| Demat Account Opening Charges | ₹0 |

| Demat Account Maintenance Charges (AMC) | ₹400 from second year onwards |

As a broker, Samco Securities also charges transaction charges, regulatory charges and demat charges in addition to the brokerage charges.

The Samco Account Opening Process is just as easy levied on the content. Here are some of the Samco Trading Account and Demat Account Opening Charges:

Samco Brokerage

Since SAMCO is a discount stock broker, it charges you a flat rate brokerage across segments. These charges are low and thus pull the SAMCO review together. The charges are as shown:

| Samco Brokerage Charges | |

| TRADING SEGMENT | BROKERAGE CHARGES |

| Equity - Intraday | ₹20/Transaction or 0.05% whichever is lower |

| Equity - Delivery | ₹20/Transaction or 0.50% whichever is lower |

| Equity - Futures | ₹20/Transaction or 0.05% whichever is lower |

| Currency - Futures | ₹20/Transaction or 0.05% whichever is lower |

| Commodity - Futures | ₹20/Transaction or 0.05% whichever is lower |

| Equity - Options | ₹20/Transaction |

| Currency - Options | ₹20/Transaction |

Use this SAMCO Brokerage Calculator to calculate the charges and your profit.

“To avail Call and Trade facility at SAMCO, You need to pay ₹20 brokerages for each order execution.”

Samco Transaction Charges

Apart from account opening and brokerage charges, here are the SAMCO transaction charges levied on the client:

| Samco Transaction Charges and Taxes | ||||

| CHARGES | Delivery | Intraday | Futures | Options |

| Transaction Charges | NSE - ₹3.45 per Lacs (0.00345%) | NSE - ₹3.45 per Lacs (0.00345%) | NSE - ₹2 per Lacs (0.0020%) | NSE - ₹53/- per Lacs (0.053%) on Premium |

| BSE - For A Group and B Group Shares – ₹1 per trade | BSE - ₹3.45 per Lacs (0.00345%) | BSE - ₹1 per trade | BSE - ₹1 per trade | |

| For other groups - ₹3.45 per Lacs (0.00345%) | - | - | - | |

| For XC, XT, XD, Z and ZP – ₹100 per Lacs (0.1%) | - | - | - | |

| For R and P Group – ₹1000 per Lacs (1.0%) | - | - | - | |

| CM Charges | Nil | Nil | NSE - ₹0.25 per Lacs (0.00025%) | NSE - ₹7.5 per Lacs (0.0075%) on Premium |

| BSE - ₹0.25 per Lacs (0.00025%) | BSE - ₹7.5 per Lacs (0.0075%) on Premium | |||

| Physical Delivery - ₹100 per Lacs (0.10%) | Physical Delivery - ₹100 per Lacs (0.10%) | |||

| GST | 18% of Brokerage, CM & Transaction Charges. | 18% of Brokerage, CM & Transaction Charges. | 18% of Brokerage, CM & Transaction Charges. | 18% of Brokerage, CM & Transaction Charges. |

| SEBI Charges | ₹0.10 per Lacs | ₹0.10 per Lacs | ₹0.10 per Lacs | ₹0.10 per Lacs |

| STT | ₹100 per Lacs (0.1%) | ₹25 per Lacs (0.025%) on Sell side | ₹10 per Lacs (0.01%) on Sell Side only | ₹50 per Lacs (0.05%) on Sell side premium |

| Stamp Duty | 0.015% or 1500/crore on buy side | 0.003% or 300/crore on buy side | 0.002% or 200/crore on buy side | 0.003% or 300/crore on buy side |

You can calculate these charges by using the SAMCO calculator.

Here is a sample trade for you with the data to give you an idea of how much you will take away and how much you will be required to pay to SAMCO.

Samco Advantages

Some of the positives of using the services of this discount broker are:

1. The new-gen Samco trading application

- Personal Index – Track your true stock market performance

- Net worth tracker – Track your real time net worth movement

- Star fund manager comparison – Compare your personal index performance with star fund managers of mutual fund houses

- Social sharing feature – Share your personal index outperformance certificate with your friends and family

2. Advanced options trading

- No restrictions on strike price in options trading

- Access all strike prices at one place in the option chain analysis

3. Advanced futures trading

- Pay only exchange requirement margins. No extras & no buffers

4. Advanced charting experience

- Get free TradingView access by opening a free Samco demat account.

5. Margin Trade Funding

- Margin against cash – Get 4X margin against cash balance in 500+ stocks.

- Margin against shares – Initiate trades even at Zero cash balance getting margin against stocks

6. Stock rating

- Invest/ trade in top-rated stocks with Samco

7. Stock SIP & ETF

- Invest in stocks or ETF via SIP within 2 mins with Samco

8. Market news & insights

- SamShots – Get actionable market insights straight from the Samco research expert.

9. Advanced watchlist

- Market movers – Directly get access to market gainers and losers in the watchlist

- Futures OI Buildup – Get the open interest (OI) activity of all the futures segment stocks and indices.

- FI DI data – Get the lists of the net purchases of FIIs and DII’s daily

Samco Disadvantages

- You must be aware of the following concerns before you make up your mind on opening your demat account with this discount broker:

- No monthly or yearly fixed price plans for heavy traders.

- Traders have raised security concerns in the case of trading platforms.

- Concerns regarding mobile apps have been raised regularly.

- “0.05% is the complaint percentage of active clients of SAMCO, as per the latest numbers in this financial year. Further, no client has filed an arbitration against the broker.”

Conclusion

SAMCO Securities is a discount broker founded by Mr. Jimeet Modi. It is based in Mumbai and is famous for charging one of the industry’s lowest brokerage charges.

It extends the service of unique margin products and multiple trading platforms. They present the highest percentage of leverage.

Moreover, India’s first capital league – ITL (Indian Trading League), was launched by SAMCO Securities.

They aim to extend the various trading services at the lowest cost possible and facilitate them with multiple trading platforms. However, their attempts have seen lesser successes in the case of trading platforms.

According to reviews on multiple fora, the platforms have regularly disappointed the customers and even led to huge losses.

Not only this, customer support has been less of a support to the users and more of a business dealing. To achieve the best of their capabilities, SAMCO needs to focus on multiple things and make itself reliable in the customers’ eyes.

The above statements do not mean that there are no advantages or good sides to the story. The broker extends the facility of learning about the share market using videos for beginners and intermediate learners.

Further, it also has the option for NRIs to have an NRI demat account.

“SAMCO did well initially, but there have been a lot of concerns raised by its client base. These concerns are in low performing trading platforms, below quality customer service, hidden charges, etc.

So, if you want to have a word with SAMCO executives, you may go ahead. Still, we are sure about the realization that many grey areas need immediate attention from the broker, including their trading platforms, customer service, and transparency.”

This information was all about the SAMCO Securities review. We hope that this was helpful to you. For further details, you could comment below.

If you are willing to open a demat account with the renowned stock broker then, enter your details below and get a Free call back right away to guide you more about the broker.

Samco Frequently Asked Questions

Here are some of the most commonly asked questions about SAMCO:

SAMCO is a discount stockbroker from the house of Samruddhi Tradecom India Limited. So from the background perspective, the broker looks safe.

However, there have been quite a few complaints raised by the clients recently. The biggest concern is the kind of exposure they offer to their clients.

Well, this feature has its positives and negatives. And thus, the inclination towards risk becomes a tad bigger.

You can check this review on SAMCO Complaints for further reference.

2. What is the minimum amount to maintain with SAMCO?

There is no such condition set up by the broker, and you don’t need to maintain a minimum balance in your trading account with the broker.

But you are required to pay ₹25,000 as the minimum trading account balance when you open the account with the broker.

3. What happens if the client fails to pay off the margin call while using the leveraged product – CashPlus?

When the client cannot pay off the margin call within the stipulated time, the client’s open positions are squared off, and the accounts are settled accordingly post square-off.

4. Is the leverage product CashPlus available for derivatives trading?

No, it is only available in the Equities segment.

5. How can I close my account with SAMCO?

You need to follow a few necessary steps if you are looking to close your demat account with SAMCO. Please follow this link on How to Close Demat Account for complete details.

6. Is SAMCO offering the lowest brokerage charges in India?

SAMCO, by no means, is offering the lowest brokerage charges in India. If you look closely, it is even more expensive than Zerodha or 5Paisa. There are a lot of other stockbrokers that offer competitive and affordable brokerage services.

7. What are the account opening Charges?

There are no account opening charges, but the broker charges you ₹400 for your demat account’s annual maintenance.

8. How to login to the SAMCO back office?

You have to enter the SAMCO star login credentials to access the back office portal.

9. What are the brokerage charges with SAMCO?

For Equity Intraday or Delivery, the maximum brokerage you are charged is ₹20 per executed order. They don’t have any fixed brokerage plans for their clients.

You can check out the detailed comparison of Samco Vs Other Stockbrokers here

More on Samco:

If you are looking to know more about Samco, here are a few reference links for you

I m Clint of samco 24 old they cheat me and a lots of fraudunt in this firm they cheated me 7000 -8000 thousands rupeese without any trade

Samco is good in terms of customer support and charges but….. wait….

Security of your data can be at great risk as the back office “samco star” website is not secured.anyone can attack data and may having malware and viruses.It is having protocol “http” and not https”.

We are not expecting this from the company like samco.

Thanks for finally writing about >Samco Review for 2019 | Brokerage, Platforms, Service | Video Review <Loved it!