ARQ Angel Broking

Check Reviews of All Terminal Softwares

ARQ Angel Broking is an automated investment engine that runs on:-

- Insights from Angel Broking Research Experts

- Machine Learning language

- Deep Industry Trends

- Cognitive Algorithms

- Amiable Processing power

Let’s review this recommendation technology by the full-service stockbroking house:

Angel Broking ARQ Review

ARQ is available exclusively for Angel Broking customers through Trade Angel Broking and Angel Broking app.

Also, read How to use Angel Broking App

At the same time, it is not a PMS (Portfolio Management Services) – thus, it is up to the client to accept or reject the recommendation.

ARQ provides in-app and web notifications along with the SMS services providing recommendations at the right time.

In this quick review, we will have a look at its demo where we will understand how to use this algo trading based feature. We will also try to know how ARQ works internally and allocates recommendations to different investors. This seems to be an interesting product from the stockbroking house of Angel Broking.

Angel Broking ARQ Demo

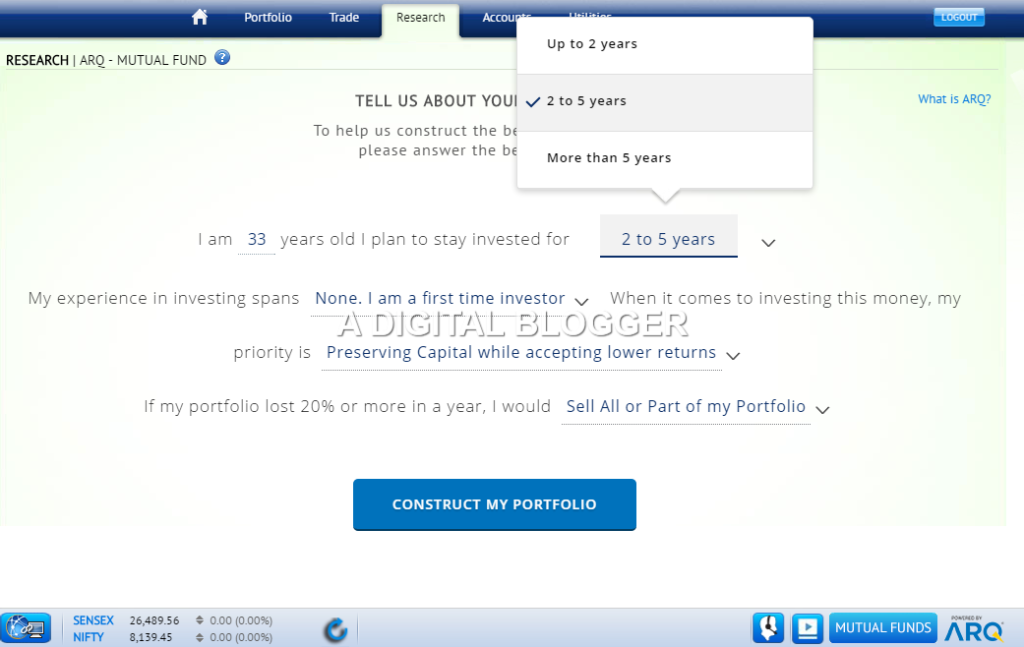

In this ARQ Angel Broking Review, our team tried to have a walk-through of the technology and the following were our observations. It basically takes in few inputs from the user around:

- User age

- Investing experience

- Portfolio risk

- Risk appetite

- Investing behavior

It uses the current trends, user inputs and develops a future predictive analysis to calculates the best possible asset allocation strategy for that particular client both in Equity and Mutual Funds (Large, small, mid, multi-cap and ELSS funds) segments.

Based on the inputs given by the team, the ARQ system within Angel Eye provided us with the following allocations.

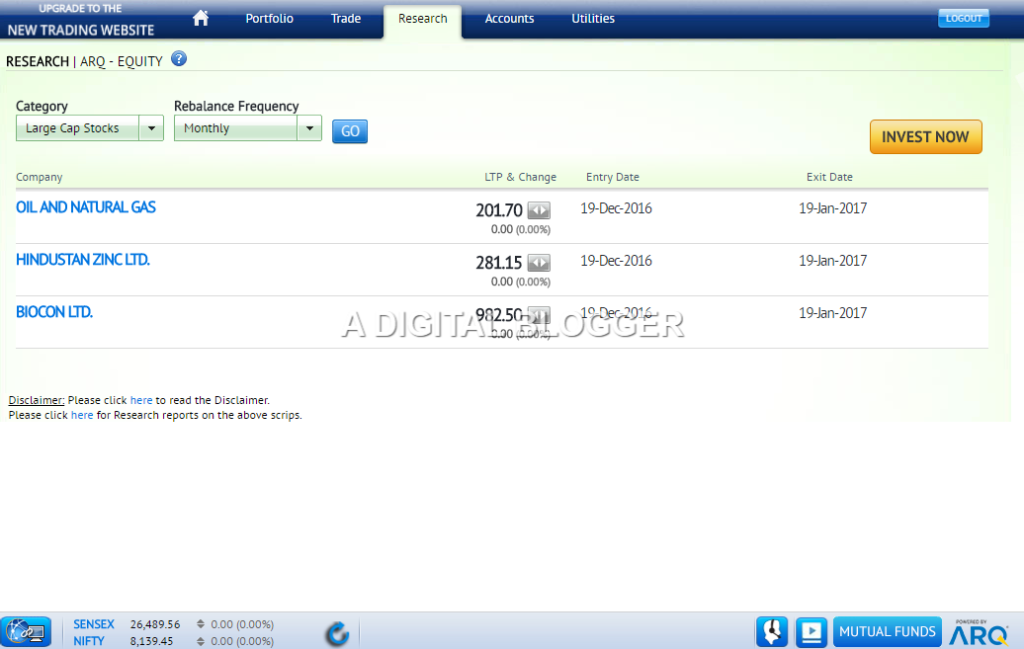

The way it basically works is that if you are looking to invest ₹1,50,000 in Equity, ARQ recommends you buy “Top 3 Stocks” for that particular day.

You have to invest ₹50,000 equally in these “Top 3 stocks” for a period of 1 month and then wait for next month’s “Top 3 stocks”.

If for your portfolio, these “Top 3 stocks” stay the same then you don’t have to take any action, however, in case there is a difference then you are supposed to sell off the stocks that do not appear in the next month’s recommendation and buy new recommendations.

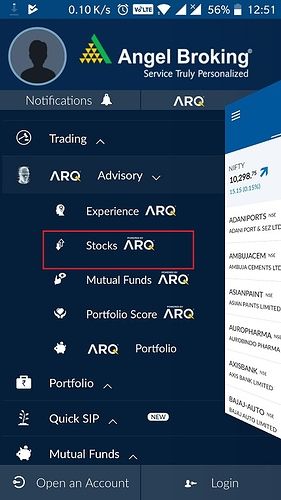

ARQ Angel Broking facility is also available in the mobile trading app of Angel Broking for Equity investments too that will help you to know how you can kick off your investing:

Angel Broking ARQ Score

All the recommendations provided by ARQ Angel Broking come with a specific score. As per the claims of the broker, this score is calculated post running multiple data points.

This stock-specific score helps in figuring out the health of the stock and mutual fund investment products.

To find out the ARQ Score, you just need to put in the stock/mutual fund name and the algorithm will provide the corresponding score for the current moment.

Higher ARQ score implies you can go ahead and invest in the corresponding score. At the same time, stocks with weaker ARQ score can be avoided.

ARQ is also enabled in Angel Bee app which is specifically offered by the broker for mutual fund investments.

Angel Broking ARQ Performance

Building a tool is one thing. BUT, anyone would want to know the actual performance of such tools in the stock market and the kind of returns investors can expect.

As per the claims of Angel Broking, this is the snapshot of Angel Broking ARQ performance over the last 2-3 years in terms of returns:

- ARQ Index Beat BSE100 by 26.9%

- ARQ Fundamental Stocks beat BSE 100 by 26.7%

- ARQ Value stocks beat BSE100 by 2.6%

Now, if you are looking to become a client of Angel Broking, it makes sense to get the actual details in terms of the stocks recommended in the past and how those recommendations were able to beat the market.

You can get these details from the broker executive during your account opening discussions.

Angel Broking ARQ App

There is no separate app or trading platform for Angel Broking ARQ. If you wish to use this algo-trading technique, you can avail it while using Trade Angel Broking or Angel Broking App.

This feature is built-in within these trading applications and in fact, you will be able to find ARQ feature across multiple spots in these apps.

Angel Broking ARQ Download

If you are looking to use and download Angel Broking ARQ, you can just download the app either from the Google play store or from the iOS store, depending on your mobile phone type.

Post download, you can check this feature through the guest login.

You may choose to open the Angel Broking Demat account as well to use the feature completely for your trades.

ARQ Angel Broking Benefits

Some of the aspects of how ARQ Angel Broking is different from traditional advisory services:

- Takes away any sort of human emotion bias

- Recommendations based on the future prediction of stock market performance instead of the stock’s past behavior

- Free of cost for Angel Broking clients

- Provides notifications based on the trading behavior automatically in the system without any human intervention or dependency

- Clients receive recommendations to buy 3 stocks through SMS from the “universe” of fundamental stocks. As per the broker, these 3 stock recommendations change every single day.

- Powered by deep industry insights and machine level learning

When you start using ARQ, you just need to follow the recommendations provided by the engine and place your investments accordingly. In that way, you are being your own fund manager.

ARQ Angel Broking Concerns

Some of the concerns with ARQ Angel Broking:

- Since the concept is technology-driven, it is very hard to prove anything if something goes wrong.

- Although it is the first such step towards digitization in trading recommendation it will still take some time to prove its value.

- The engine does not give or promises any range of return percentage. That is simply strange for the reason that at one place the broker claims that the engine has been run over millions and billions of data points and on the other hand, they don’t have any clarity on the kind of returns a client can expect by following the exact same stocks and holding those for the recommended duration.

“The biggest flaw is that the broker claims the recommended stocks change every day while it is not always the case.”

- The investment duration for ARQ recommendations is at least 12 months, so users can not ripe quick benefits with this concept.

- ARQ engine’s capability is limited to Equity and Mutual funds. There is no set up for Commodities, Currency or any other investment segments.

Conclusion

We think that ARQ is suitable for users with the following set of benefits it provides:

- Users who are digital savvy and prefer online modes of trading.

- Anybody who is looking to enter into trading or investing in mutual funds but does not have the know-how of how the market works and wants to work with lower risk.

- Anybody who is looking for recommendations but does not really prefer or have the time to go on calls on each to understand the best possible.

- Since the complete concept is based on an automated algorithm, there are no chance of any human errors that can lead

Also Read: Angel Broking Review, Angel Broking Comparisons with other Stock Brokers

Have you experienced ARQ already? Let us know your experiences in the comments below.

In case you are interested to have a word for Demat and Trading Account?

Enter Your Details here and get a FREE call back.

ARQ Angel Broking FAQs

Here are a few frequently asked questions about this recommendation engine from Angel Broking. Let’s have a quick look:

Are the recommendations provided by ARQ generic in nature for all clients?

No, ARQ Angel Broking provides personalization recommendations to different clients based on multiple factors such as investment amount, risk appetite, lock-in period etc. The suggestions provided are across angel broking equity, debt and gold mutual funds across large, mid, small and multi-cap funds.

Is there any minimum amount I need to start with if I use ARQ Angel Broking?

There is no minimum amount that you need to take care of. You may choose to start with any comfortable amount based on your return expectations and disposable income.

Do I have to open a Demat account with Angel Broking in order to access ARQ?

Yes, opening demat account with Angel Broking is mandatory in case you are looking to use ARQ for trading and mutual fund investment recommendations. You can choose to open account with Angel Broking by providing details.

Is there any minimum amount of time I have to stay invested in the funds recommended by ARQ?

The funds suggested by ARQ Angel Broking supposedly have a minimum holding period of 1 year. However, as per the claims of the broker – after 1 year you will be notified on whether you stay invested in the same fund for the next year or switch to a different one.

More on Angel Broking:

Here are some other related articles on Angel Broking for your reference: