Smallcase Zerodha

Check Reviews of Web Trading Platforms

Smallcase Zerodha is one of the partner initiatives between both the businesses i.e. discount broker Zerodha and Smallcase – a financial tech-based company. The latter has similar partnerships with few other stockbrokers as well (such as 5Paisa, AxisDirect, Edelweiss Broking, HDFC Securities etc).

The whole idea of such initiatives is to bring additional value to clients and in this case, it is towards people looking for long-term investments.

Let’s have a detailed look at how it works and how you can leverage value from it.

Smallcase Zerodha Review

Before jumping into the review of Smallcase Zerodha, we need to understand what exactly is smallcase? How does it help in investments? Why do we need it and so on!

Basically, Smallcase is an equity investment platform, designed specifically for retail investors taking into account two prominent investment strategies – themantic and portfolio-based investing.

Wait, what is themantic investing?

Themantic investing is basically investing in the changes we see around us.

These changes could be anything such as changes in the mindset of people towards branded products, new infrastructure developments around specific cities or types of cities of the country, change of government policies towards any particular domain such as smart cities, metros, powertrains, the introduction of GST etc.

Making sense? Let’s dig deeper!

Basically, these investments are not targeted primarily onto stocks, but themes, ideas, observations that can create potential opportunities in a segment or more.

The best part of themantic investments is it is future driven and not on historical trends, thus, creating future profitable investment scenarios. There can be such initiatives in the tourism industry, the luxury industry, and so on.

Alright, that makes sense! And what about Portfolio investing?

Portfolio investing focusses on a set or sub-set of stocks instead of a specific stock or two. For instance, due to the growth of e-commerce in India and inclusion of demonetization recently, the market has seen recent improvements in the stocks of banking space, simply because major retail purchases are being done online.

And thus, a lot of banks have gained traction in terms of value to go along with high cash assets.

So, if a person ‘A’ saw all that, with media through newspapers and television channels echoing the same point, he/she would pick a particular bank based stock and invest in it. What if that particular bank goes down the barrel due to other factors while other banks enjoy a huge rise in the stock market valuation.

Honestly, this can happen!

Thus, to cater to such situations, portfolio investing comes into play where it diversifies your investment into multiple stocks within the same industry and helps you NOT to put all the eggs in the same basket.

How Smallcase Zerodha Works?

Coming back to Smallcase, it basically takes both themantic and portfolio investing strategies into consideration and creates separate themes across multiple industries, domains, external situations etc.

This needs to be known that once you have gone through the Zerodha demat account opening process, you will be provided access to this system post subscription and it would be easy to open Zerodha Demat Account.

Let’s take the example of Smart Cities concept where our government is putting up multiple efforts in creating smart cities out of the 3rd tier cities of India.

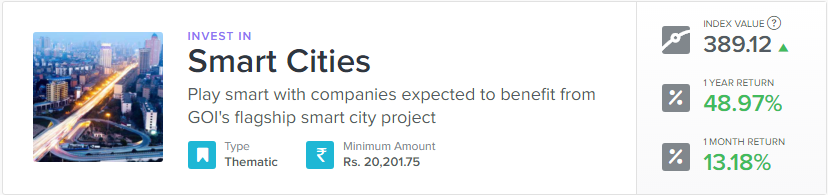

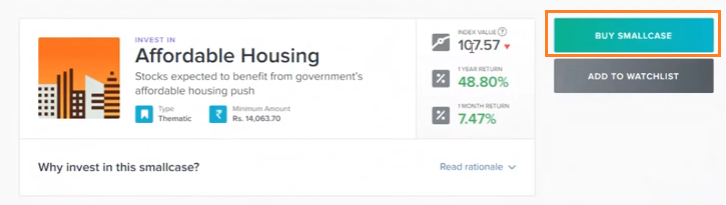

This is how a theme introduction looks like within the Smallcase Zerodha platform:

This concept directly impacts infrastructure, education, retail, telecommunications, transportation and a few other sectors. Now, there will be companies coming from these sectors that can potentially see growth opportunities due to this very concept.

Although it started as an integration first with Zerodha, smallcase is now available with Axis Direct and Edelweiss broking as well.

What smallcase does is, it picks out specific company stocks coming from these sectors through their research and create a theme out of it. The theme is called – Smart Cities. This theme is made of multiple stocks coming from multiple business sectors and is seeing an overall growth together.

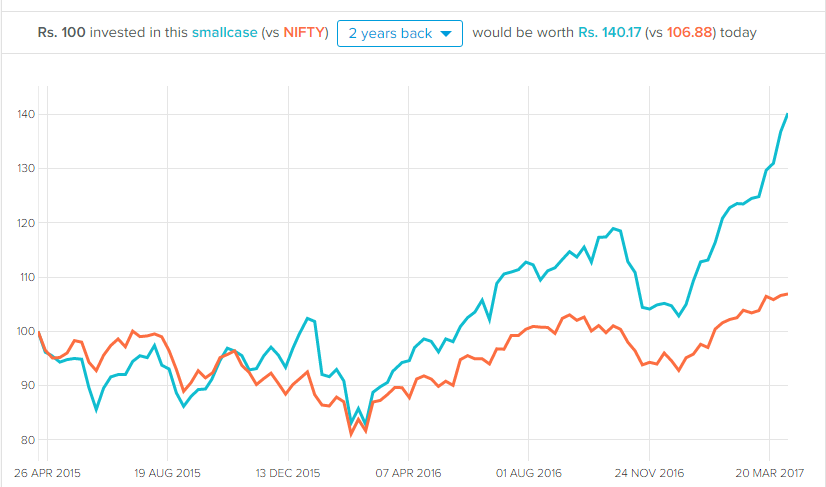

For instance, this is how the theme growth graph looks like:

The graph above is basically telling that the stocks within this theme, once invested together through this theme via Smallcase, would have given 40%+ returns in 2 years time. Users can view the returns percentage for durations of 1 month, 3 months, 6 months, 1 year along with 2 years.

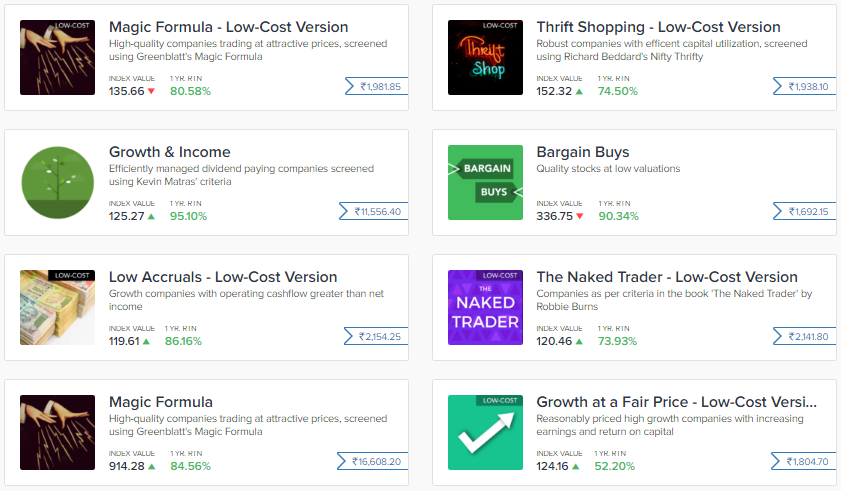

Similarly, there are around 70 such themes that contain a mix of stocks that can get impacted by external situations and opportunities. Each of such themes contains 15-20 stocks based on the research done.

This shot gives an idea on the kind of return you can expect in as less as 1 month to as high as 1 year to go along with the minimum investment amount you need to invest to see that percentage growth.

Having said that, all the return percentages depend on the market condition and how you pick up a specific theme for investment. This tool, by no means, provides any sort of guarantee for stock market returns.

This is fine but, How is a smallcase Zerodha theme built?

As per the team from smallcase, they would go through the following process while they build a smallcase:

- Start at a very broad level and wonder across all stocks listed on the stock market

- Detailed research on the numbers, indices, external situations that can potentially impact industries, geographies to boil down to a theme topic.

- List down specific sectors, companies that can get impacted by the industries of the theme selected above. This requires the research team to figure out which particular companies are inclined towards what kind of models and whether the selected theme topic will impact them or not. It’s not mandatory that every company in a particular industry will get impacted and thus specific companies get picked out.

- Stock screening is down via algorithms and models developed by smallcase.

- Set up corresponding investment weights against the selected stocks.

- The same process is re-run after a particular period to see any potential inclusions or exclusions of selected stocks.

Thus, smallcase investments present potential investment opportunities based on a decent amount of research done on the subject. It also tells what you can potentially expect in terms of percentage returns along with the investment period and minimum investment needed.

Sometime back, Zerodha Smallcase 2.0 version was launched as well. As per the claims of the broker, this version has better user experience and is cleaner in design for easier usage.

Smallcase Zerodha Mobile

This investment application is also available in a mobile variant. Like the web version, the mobile app also provides users with around 70 themes to choose from for their respective investments.

You can place your investments with a couple of clicks (or taps) and track those while on the move.

However, there are a few concerns with this mobile version of smallcase:

- Zerodha Login related issues observed by some clients

- Screeners not available in the mobile app unlike the web version where you can access

Here is a quick look at how the Smallcase Zerodha Mobile version looks like:

Furthermore, here are some of the stats of smallcase Zerodha from Google Play store:

| Number of Installs | 50,000+ |

| Mobile App Size | 8.3 MB |

| Negative Ratings Percentage | 8.1% |

| Overall Review |  |

| Update Frequency | 2-3 Weeks |

Smallcase Zerodha Screeners

The smallcase tool also provides with screeners feature where a user can just place filters such as target price, future expectations and so on. Once it is done, the tool’s screeners functionality helps in providing specific stock names where investment can be made.

There are 2 pricing plans for stock screeners:

The first plan is free to use, where you are provided with basic filters and screens, but offers no exports and just 3 screens to be saved.

Then there is a Pro plan, that comes with 4 different variants of timelines:

- 1 Month: ₹118

- 3 Months: ₹336

- 6 Months: ₹637

- 1 Year: ₹1133

You can choose to cancel the subscription as per your choice and the plan will not be renewed automatically when the renewal date arrives.

Smallcase Zerodha Charges

Smallcase Zerodha charges ₹100 per smallcase you buy irrespective of the investment value you put in. So, if you are interested to invest 50,000 in 3 different small cases – then you will be charged ₹300 in total.

Later, if you want to increase your investment in the small cases you have bought already, there is no extra fee.

Smallcase Zerodha Account

Since smallcase works in partnership with Zerodha, thus, first of all, you need to have a trading account with Zerodha. You can open the trading account with Zerodha by providing your details here.

Once you have selected smallcase(s) for your investment, you need to go to the smallcase page. Once you are there, you need to click on the ‘Buy Smallcase’ button as shown below:

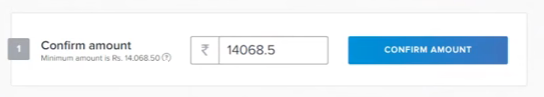

Once you click the button, you will be required to confirm the amount you are looking to invest in this particular smallcase. There is always a minimum investment set for a smallcase, although you can choose to invest more than the minimum amount set for the smallcase investment. Once you enter the investment amount, you need to click on the ‘Confirm Amount’ button, as shown:

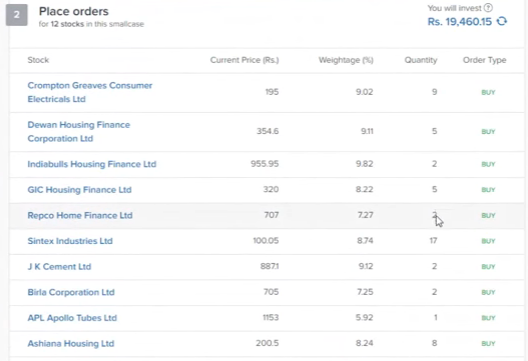

Post that, you will get to see different stocks, corresponding quantities and amount invested through smallcase in those selected stocks. Your total investment will be divided among different stocks as per the weight set by the research team.

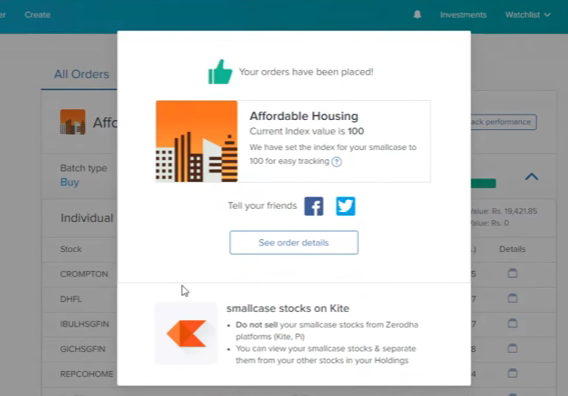

Once you confirm the order, you will be directed to the order confirmation as shown below:

Further, you can also track your investments by click on the ‘Track Investment’ button.

Yea, but everything cannot be good with it, right!

Smallcase Zerodha Returns

As far as smallcase Zerodha returns are concerned, it really depends on the smallcase you are investing in. There are different smallcases with the different risk-return ratios that end up deciding the kinds of returns you can expect.

Furthermore, there is no specification in these investments that says higher risks lead to higher returns or vice versa.

For instance, Smallcase named ‘Smart Beta‘ picks ONLY liquid stocks from the top 150 market cap stocks from the NSE and it provides returns better than the Nifty Index and Zerodha ETF.

Similarly, there is another smallcase named ‘All-Weather‘ that invests in 3 asset classes namely – Debt, Gold and Equity. The smallcase rebalances the overall portfolio from time to time in order to bring higher returns for the investor.

Thus, in simple words, make sure you understand the smallcase you are going to invest in to get an idea on the returns you may expect.

Smallcase Zerodha Customer Care

This investment product ‘Smallcase’ has a couple of communication channels:

- Web-chat

There are no phone communications, as of now, offered but overall the customer care quality is around average.

The web-chat facility can be used post logging into the smallcase Zerodha application and clicking on the chat button present at the bottom right.

In case you do not get a quick or any resolution using the above communication channels, you can get in touch with the Zerodha customer care team as well.

Zerodha Smallcase Vs Mutual Funds

Well, there are a few differences between Zerodha smallcase vs Mutual funds, some of those are listed below:

- Smallcase Zerodha allows you to buy specific stocks against the whole fund in case of mutual funds.

- The risk ratio is marginally higher in smallcase Zerodha as compared to regular mutual funds investments.

- There are no lock-ins in case of your smallcase Zerodha investments.

- You can acquire a smallcase with a very small initial investment, unlike mutual funds.

There are a few clear areas where both these types of investments differ. However, which one is better, we will leave that to your wisdom!

Smallcase Zerodha Disadvantages

There are few concerns with the platform you must be aware of, such as:

- Incomplete integration with Zerodha Kite Platform

- There is no definite guarantee that the tool will provide you with regular returns, so you need to be savvy at your end as well.

- BSE stocks are not supported in the platform, yet.

Smallcase Zerodha Advantages

Further, it certainly provides the following positives for investors or beginners:

- Users can customize a smallcase, add new stocks or remove some of the existing ones as per users’ preferences.

- You don’t need to go through any fundamental research on your own. That part is already taken care.

- Diversifies your investment across industries, company stocks and keeps minimal risk on your initial capital.

- Well-designed and easy-to-use application, especially the 2.0 version.

- Apart from Zerodha, Smallcase is now available with AxisDirect and Edelweiss broking as well.

Looking to open an account and get started with investments?

Provide your details below and we will set up a callback for you:

More on Zerodha:

If you are looking to understand more about this discount broker, here are a few resources for your assistance:

Thanks, very informative.