Zerodha Bracket Order is one of the unique offerings provided by the discount broker – Zerodha. This post is intended to review the Zerodha Bracket Order. Before the review, it is imperative to define the Bracket Order (BO).

Let’s start with the basics and then build onto this trading concept.

Zerodha Bracket Order Review

Bracket order is almost like the cover order but with little advancements in it. We used to place an order for buying or selling along with the stop loss in the cover order. Here, Bracket Order is more about the needed flexibility in putting the same order.

In bracket orders, we can keep the buy or sell order along with stop loss, the target price, and the trailing stop loss in one window altogether. So, the bracket order has got some reasonable advancement for the user significantly.

Also Read: Zerodha Margin for Bracket Order

Zerodha Bracket Order: To start using your Zerodha bracket order logging into your trading account is your first step.

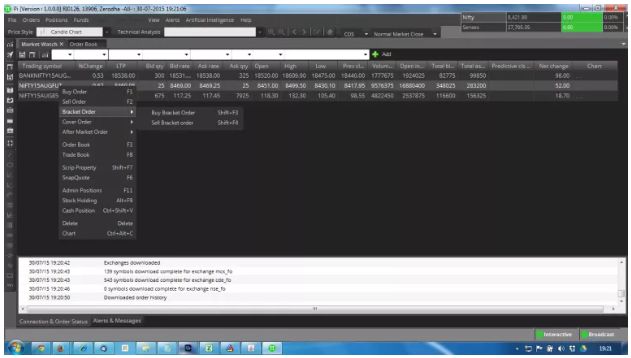

You can log in into any of the trading platforms offered by Zerodha, be it Zerodha Kite, Zerodha Kite Mobile App or Zerodha Pi – the terminal trading software.

Now, you need to select the scrip for which you want to place the Bracket Order.

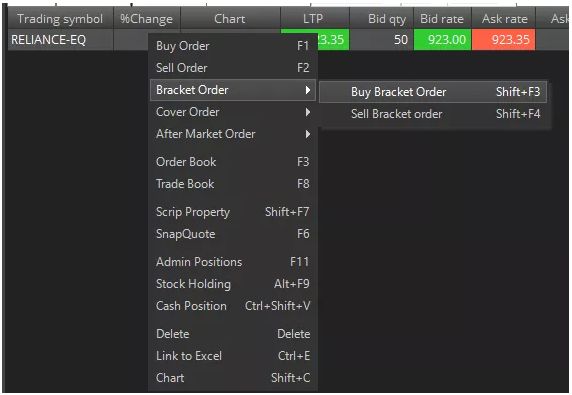

The right click over the scrip enables selection to buy or sell order option in the Zerodha bracket order.

Shift+F3 is keyboard shortcuts to do the same but Shift plus F3 is buying option and Shift plus F4 is for selling option. Now, this is about how to start using your Zerodha Bracket order.

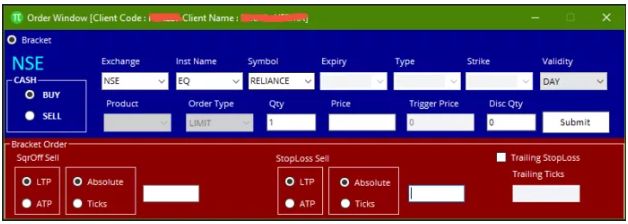

After selecting the buy option in bracket order will enable the new window in the form of a pop-up. Novice or beginner level users may find it little complex with the buttons as LTP, ATP, Ticks and Absolute Option in the way shown in the below image:

It is important here to remember that a bracket order type is always a Limit Order.

Similarly, all are bracket orders are deemed to be MIS that is intraday order valid only for that day. LTP or Last Traded Price is the price at where the last trade has been executed in the markets.

Similarly, ATP or Average Trade Price is the average price of that particular scrip executed on all the trades. The Absolute option is provided in BO for entering the high and low points for the target and for the stop loss.

It means selecting Absolute option requires providing target price points as well as stop loss. For example, your limit price is ₹893 and the target price is ₹900, then it is essential to provide 7 in the Absolute price box. There is Ticks option in the bracket order and it implies that the user must mention target as well as stop loss in the ticks’ value.

Here, every tick is valued as 0.05 paisa or the points within the Indian markets. For example, my target price is 5 points above to the limit price then it is required to enter 5/0.05=100 points.

Zerodha Bracket Order Example

Now, assuming you are familiar with the features of the Zerodha Bracket Order.

Let us see one example transaction on this Bracket Order in detail.

Let us place a bracket order for example, on ONGC. Initially, the Limit price needs to be entered at the Limit Price Box of Zerodha Bracket order. Let us say the market price of ONGC currently is ₹950 and the user wants to keep the Limit Price as ₹940.

Now, Target Price needs to be entered.

Here, the target price is ten points above to the limit price. Then, select the Absolute option with 10 within the box. This will enable the position squared-off as soon as market price reaches the set 10 points limit above to the current price that is ₹(940+10) = ₹950.

Let us use the stop-loss option too. Keep the stop loss limit to 3 points that is ₹(940-3) = ₹937.

You can carry it by selecting the absolute option with 3 points and now you can submit t your order by clicking over the SUBMIT button.

Now, what happens within the Zerodha Bracket Order after submitting the order will be seen.

You sent 3 orders to execute.

The first order is Limit Order to 940 points, the 2nd order is Target Order to 950 points and the 3rd order is Stop-loss 937 points. The system will square off the order as soon as it hits stop loss or target.

If the target order executed first, then the stop-loss will be cancelled automatically. If stop-loss is executed first, then Target order turns null and void.

Now, you’re totally familiar with the Zerodha Bracket order, its features and how effectively it can be used. It is an expanded assurance for your trading by ensuring profitable position by trying its level best by mitigating the losses.

The Zerodha BO is one of its kind in India while it is applicable only on F&O and equity only but cannot be used on commodities.

Trailing Stop Loss in Zerodha Bracket Order: The best part of Zerodha BO is its trailing stop loss. When a user is utilizing bracket order trading, it enables the best choice either to enable the fixed stop loss on trading or to trail the stop loss.

It means the selected stock or future will move towards the specified ticks mentioned in the BO. It means, stops loss may go down or up in the event based on the short or long position.

Salient Aspects of the Zerodha Bracket Order:

Here are some of the salient aspects related to a Zerodha Bracket Order that you must be aware of:

- It is important to be aware that the BO is an intraday product that automatically squared off by the end of trading time that is 3.20pm.

- Zerodha Bracket Order is effective and applicable only on Equity, Currency and F&O, but not allowed to use on commodities.

- Your Zerodha Bracket Order is best and more effective on the Zerodha’s Pi platform.

Zerodha Bracket Order – Conclusion

Now, the details and effective usage of the Zerodha Bracket order is explained above in detail. It is definitely very helpful for traders on equity, currency and futures. Initially, it may sound like little complicated but down the line turns into quite user-friendly.

The Zerodha tutorials and YouTube videos may be a great help here for the novice Zerodha users. Get acquainted more prior to usage by going through the tutorials and videos provided by Zerodha. It is definitely not easy for the beginners. It needs little more understanding for the perfect usage.

Bracket Order has been a great help over the Cover odder, while Zerodha brought its BO with furthermore flexibility keeping in mind the users’ interests and demands. It is definitely a far better than cover order by enabling the stop loss and trailing stop loss features.

If you really want to enable profits in your trading by mitigating losses, then this bracket order is definitely your friend. People who find it difficult or tough to comprehend are suggested not to use it until familiarizing well with its features.

It is possible for profit making and mitigating losses through bracket order by using effectively its features. So, for the effective usage of bracket order features is possible only after understanding in detail its features.

Online trading in equity, currencies and futures is profitable when played your cards well. The Zerodha bracket order is your great help to play your card well and to reduce or limit your losses. As the way technology venturing into every sector, online trading is no exception here.

The technology enabled bracket order from Zerodha is worth using on your online trading. It is the best way to safeguard your investment too.

In case you are looking to get started with stock market trading or investments in general, let us assist you in taking the next steps forward.

In case you are interested to know more about Zerodha, here are some reference articles for you: