Zerodha Intraday Trading

More on Intraday Trading

Intraday trading is taking a position in the share market and exiting it on the same day before the market closes. For trading, different brokers are available in the market out of which Zerodha is one of the best ones. In this detailed review, let us talk about Zerodha intraday trading, its various features, and how it is done.

Zerodha Intraday Trading Demo

Zerodha Intraday Trading can be done in 2 ways

Offline

In the offline Zerodha intraday trading method, a trader needs to call at the Zerodha call & trade desk. For placing a trade, one needs to know his / her “telephone code”. This was earlier known as Zerodha ZPin.

This telephone code is for the purpose of authentication of one’s identity and makes the process faster as the account information is easily available for their customer support representative.

When one is calling from the registered phone number, she/he is required to enter the telephone code in the IVR for reaching the support representative.

If someone is calling from any other phone number other than the registered one, one needs to enter the registered phone number followed by the telephone code without any space or any character in between.

This telephone code can be viewed by logging into the Zerodha Console and viewing the Profile screen.

Example: If the registered phone number is 9953489292 and the telephone code is 1234, then, one would be required to enter 99534892921234 in the IVR.

Got it?

Online

Zerodha intraday trading can be done through any of their trading platforms including the web application Zerodha Kite on a computer. Once, a trader has his / her trading account with Zerodha, one can easily make intraday transactions through it.

You can buy the intraday shares using the Zerodha Kite.

There are other similar trading platforms such as Zerodha Pi, Zerodha Kite Mobile App and you may choose to use any of these applications based on your preferences.

Zerodha Intraday Order Types

Before getting into Zerodha Intraday trading details, we need to know the basics of some types of orders. Let us take an example to understand the basic terms.

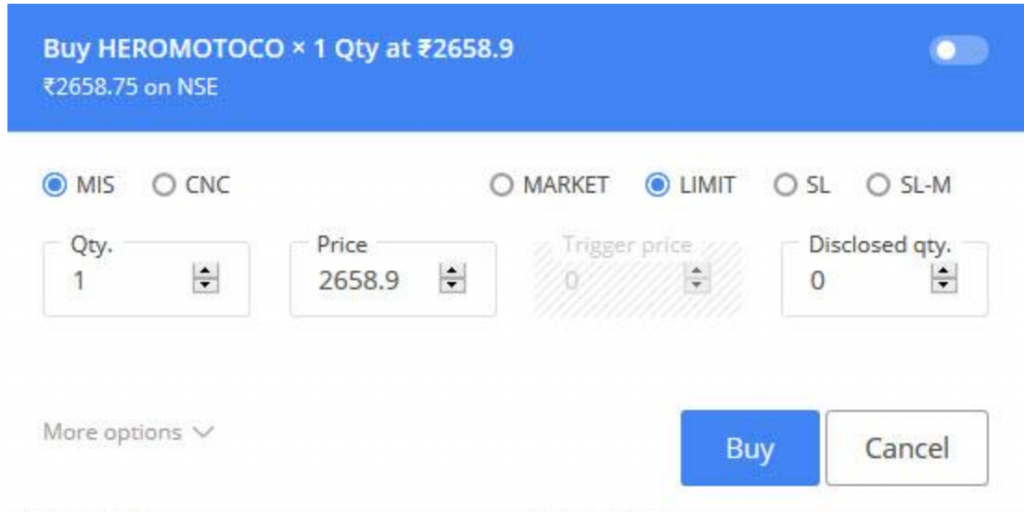

Suppose a trader wants to buy 1 share of Heromoto Corp. at Rs.2,658.90 for intraday trading, then, he/she needs to select the following things on the Zerodha platform.

The terms that have been shown in the picture below have been discussed below

1. MIS – MIS stands for Margin Intraday square off. This type of order is placed only for Intraday trading using leverage. Leverage is given in the range of 3 to 14 times according to the risk and volatility of every stock.

If one does not square off-trade before the market closes, then Zerodha square off automatically at around 3:20 pm.

2. CNC – CNC stands for Cash and carry. This order is placed for orders placed for more than 1 day and not for intraday Zerodha trading.

For more details, you can read CNC and MIS means in detail.

3. Market Order – This order is placed to buy or sell shares at the market price of that instant.

4. Limit Order – This order is placed to buy or sell shares at a specific price or better.

5. SL Order – This order is used for placing a stop loss at the limit price. You are required to provide a trigger price. As soon as the trigger price is reached, the stop-loss order is sent to the stock exchange at the limit price.

For more information, check this quick review on Trigger Price in Zerodha.

6. SL – M Order – This stands for Stop Loss order at market price. While placing this order, one needs to enter a trigger price. When the trigger price is reached, the stop-loss order is sent to the stock exchange at market price.

7. Disclosed Quantity – This option is available to disclose a part of the actual order of the number of stocks placed to buy or sell shares.

Other types of orders that are meant for intraday trading purposes are:

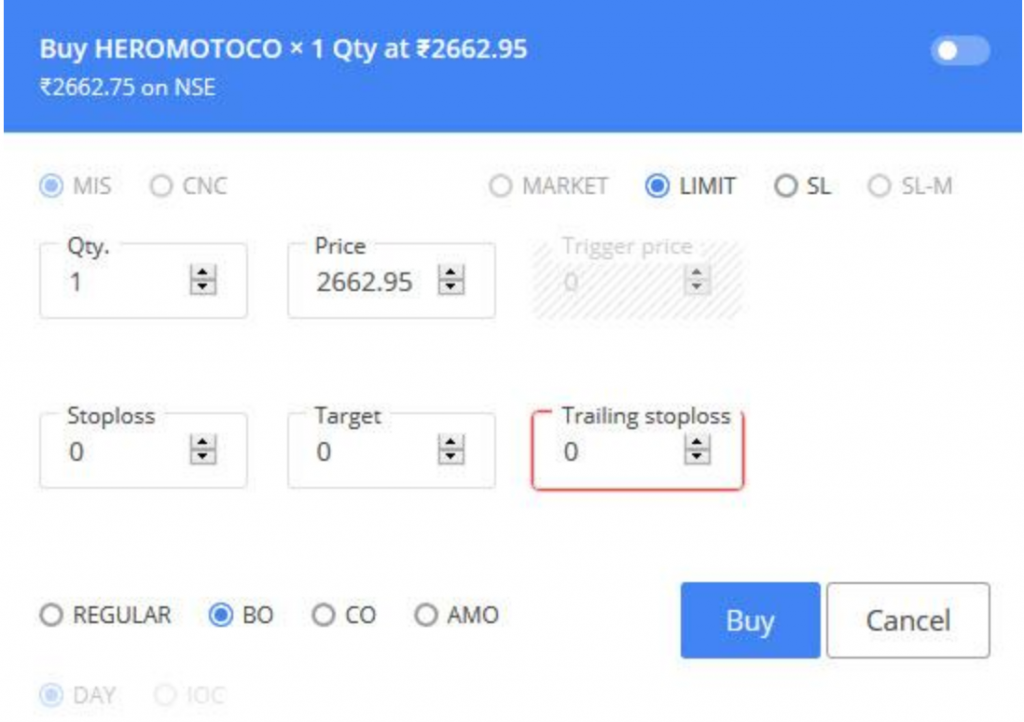

8. Bracket Order – BO stands for Bracket order. In this kind of order, one needs to place an order to either buy or sell stocks at limit order with a target price. This has to be compulsorily accompanied by a stop loss.

BO order is helpful in getting more leverage in comparison with an MIS order. BO orders need to be squared off by the end of the day at around 3:20 pm for equity and Futures and options, at 4:30 pm for Zerodha currency trading.

Bracket orders cannot be placed for commodities. They can be placed for equity, futures & options and currency trading.

In the above example, if we want to place a bracket order, we will need to go into the more options provided in the Zerodha platform and select BO like shown in the image below:

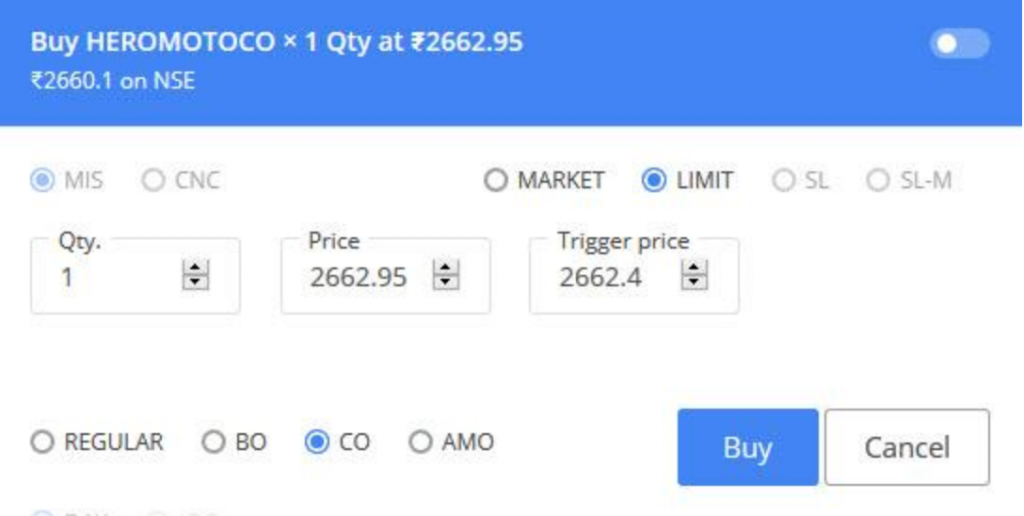

9. Cover Order – CO is an acronym for Cover order. Similar to bracket order, it is also used for higher leverage than MIS trade. Stop loss needs to be specified and the buy or sell trade is done through a market order.

Leverage given for cover orders is almost double as compared to MIS trades, ranging from 6 to 20 times.

In the above example, if we want to place a cover order, we will need to go into the more options provided in the Zerodha platform and select CO like shown in the image below:

Cover orders need to be squared off by the end of the day at around 3:20 pm for equity and Futures and options, at 4:30 pm for currency trading and 25 minutes before closing for commodities.

Other than this, Zerodha AMO order allow you to take an early position in intraday trades on another trading day with AMO order in Zerodha.

At the same time, you can also use some of the crucial Zerodha Intraday tips while placing your trade in the stock market with Zerodha Free Demat Account.

Short Selling in Zerodha

Not only during the uptrend but you can make money in the downtrend in intraday trading. Short selling is where you sell at higher price first and later buy at a low price.

The difference between these two prices is your profit. This you can easily do using the Zerodha mobile or web app.

So, let’s learn how to short-sell shares in Zerodha Kite.

How to Short Sell in Zerodha App?

To short your position in the Zerodha, first, find the stock that is trending downwards and has an average volatility of around 3-4%.

- Add share or shares to the watchlist by clicking on the + button.

- You can do further analysis using Zerodha technical indicators and charts.

- Now click on the share and then on Sell.

- Enter the quantity and order type (Market or Limit).

- Choose product type (MIS).

- To manage risk, choose the advance order type, Stop loss.

- If you want to minimize the impact cost, choose the Zerodha Iceberg order option.

- Swipe left.

- Confirm your order.

- In the case of a Market Order, it will get executed right away while the limit order will only be executed on Price Matching by Exchange.

Later you need to square off your position, as short selling is only done for intraday trades.

- To buy the shares, click on Positions.

- Click on the share (that you short-sell).

- Click on Buy.

- Execute the order by filling in the detail in the trading window.

- After executing the order, the detail of amount used for trading is displayed as the used margin in Zerodha in Kite app. On squaring off this amount is added back to the available margin.

Zerodha Intraday Charges

Now, let us discuss the various charges including brokerage applicable for Zerodha intraday trading:

| Zerodha Equity Intraday Charges | |

| Intraday Trading Charges | 0.03% or ₹20 per trade (whichever is lower) |

| STT Charges | 0.025% of the trade value (sell side) |

| Transaction Charges | NSE: 0.00345% |

| BSE: 0.00345% | |

| SEBI Charges | ₹10 per crore |

| Stamp Charges | 0.003% of the trade value (buy side) |

| GST | 18% of (Brokerage+SEBI charges+Transaction) |

Now, what do these charges imply:

- Zerodha Brokerage is levied every time you place an order. With Zerodha, higher trade value does not imply higher brokerage since they have capped it at a maximum of ₹20.

- STT or Securities Transaction Tax is levied by the stock exchange such as NSE or BSE and is generally placed on the sell side of the trade.

- Turnover Charges are levied on both sides of the trade by a specific exchange.

- SEBI charges, as the name suggests, are levied by the regulator itself i.e. SEBI

- GST or Goods and Service Tax is a central government levied-tax.

- Stamp duty charges are levied by the state government

Other than these charges, stamp duty and DP charges are also applicable on every transaction is done through Zerodha intraday trading. Stamp duties vary from state to state and the details of those can be seen at the link posted below:

Zerodha Intraday Calculator

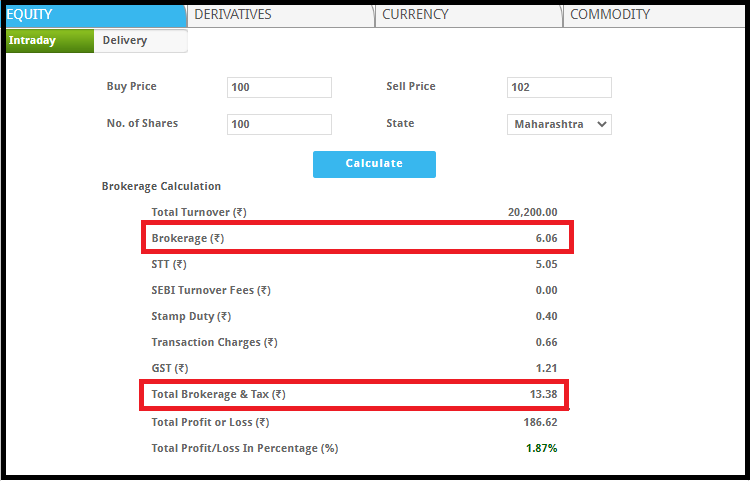

As discussed above that the charges are not limited to brokerage. There are other fees like SEBI charges, GST, STT and lots more.

That means that the overall fees are not limited to the brokerage, in fact, it includes all other fees as well.

To calculate the overall profit in your trade, it becomes essential for you to do calculations prior to trade. You can do this using the brokerage calculator where just by entering few details you can evaluate the total fees.

Zerodha Intraday Trading Time

You can perform Zerodha intraday trading at any given point in time during the market opening hours. However, you need to be a little cautious whilst you close your position.

If an open intraday MIS / BO / CO position has not been squared off before the closing of the market, it gets automatically squared off around 3:20 pm.

If due to any reason, the intraday trading position has not been squared off till the closing of the market, the position gets converted to CNC position.

This gets carried forward to the next trading day and gets squared off by Zerodha automatically if the required amount of cash is not there in the account. In such cases, no margin call is made.

Thus it is beneficial to consider intraday trading time for placing a safe and secure order.

Zerodha Intraday Margin

Trading in futures is leveraged which means that only a small amount of money called “margin” is required in the account in order to make an intraday future.

The margin calculator of Zerodha gives the complete details of margin requirements during futures trading.

One needs to enter all trade-related information in order to calculate comprehensive margin requirements for any trade.

The margin calculator has a comprehensive and exhaustive list of all stocks along with the MIS and CO / BO margin/leverage.

Learn complete detail of how to use the Zerodha Margin Calculator to avoid any confusion while doing trade. For more information, you can check this Zerodha Margin Calculator.

Zerodha Intraday Trading Tips

Honestly, there is no single formula that can be just used by everyone in order to make profits through Zerodha Intraday trading. However, there are a few quick intraday trading tips that you may choose to follow in your trades as part of the Zerodha Technical Analysis you are carrying out:

- Perform a detailed technical analysis of stocks for the specific sectors or stocks you are monitoring. There are multiple technical indicators, charts, heat maps, screeners and other related tools that can help you to make objective decisions.

- Use any mode of order placement. If it is online, then you just need to select a specific scrip. You may choose to place the order type as MIS for instance.

- Ideally, you must be placing a stop-loss price in order to keep your loss in intraday trading limited in case the trade goes in the opposite direction against your expectations.

- It makes sense to use a trailing stop-loss order in order to cash in higher profits.

- Use margin to the extent that is based on your risk appetite. People will tell you using margin is a double-edged sword. Well, they are right!

Conclusion

Zerodha intraday trading has been simplified as much as possible with the help of brokerage and margin calculators. They provide the exact amount of money involved with each kind of intraday trade.

Now, no one is required to make a trade just to check margin requirements. One can be sure of each and every paisa being charged or blocked during a trade before entering it.

Stay educated, stay smart!

In case you are looking to get started with stock market trading or investments, let us assist you in taking the next steps ahead:

Furthermore, if you are looking to know more about Zerodha, here are a few references for you:

Want to know intraday trading with margin leverage. I am demat account holder AM6072