AMO Order in Zerodha

Using the Zerodha Kite app for trading and wondering what AMO order in Zerodha is? Well! if you are a beginner and not aware of the benefits of this order type then this article is for you.

Learn.

- What AMO order in Zerodha is?

- When you can use this order type?

And,

- How to place an AMO order in Zerodha?

What is AMO Order in Zerodha?

AMO means After Market Order is one of the Zerodha order types. Let’s understand it’s importance

Now as you all know that stock market opens from 9:15 AM to 3:30 PM but what if your day-to-day activities do not let you trade in those hours?

To allow the traders and investors to place their orders even after market hours is what is called an AMO order in Zerodha. Thus, it becomes easier for everyone to actively trade or invest in the share market without any restrictions.

In simple terms AMO order allows you to trade or place an order one day before a trading session. For example, if you want to buy a share on Tuesday at the earliest then you can choose to place an AMO order before the market opens on Tuesday.

- But does the trade actually gets executed?

- Are all the options of trading and order placements available in AMO order too?

Well! to get an understanding of this, let’s understand how AMO order works in Zerodha?

How AMO Order Works in Zerodha?

Similar to the market hours order, once you choose to place the order, you are provided with an option of limit or market order which allows you to trade at your determined price or at the current price respectively.

In an AMO order, you get all the options to choose the quantity, product (intraday or delivery), the validity of the order, etc, but you are not allowed to place a SL-M order for options.

If you choose the market order, then your order gets executed at the value at which the market opens the next day.

Further, on the price matching, the order will be executed only during the pre-market session after 9:07 AM to 3:20 PM.

AMO Order Time in Zerodha

Now let’s talk about the time at which AMO order facilities are available in Zerodha. The broker allows you to trade in different segments (equity, currency, and commodity).

The market hours for all these segments are different and so does the AMO order timings. Here is the detail of the timings at which you can place an order in the Zerodha app.

| AMO Order Timings in Zerodha | |

| Equity | NSE: 3:45 PM to 8:57 AM |

| BSE: 3:45 PM to 8:59 AM | |

| Currency | 3:45 PM to 8:59 AM |

| Futures and Options | 3:45 PM to 9:10 AM |

| Commodity | Any time during the day |

However the AMO order timings are till the morning before the market opens, but in Zerodha, you cannot place an AMO order between 1:00 AM to 5:30 AM because of maintenance activity.

Other than this, the non-POA account holders will face an error while placing an AMO because of the requirement of TPIN authorization by Zerodha.

How to Place AMO Order in Zerodha?

After understanding the meaning, working, and timings of Zerodha, let’s now learn how to place an AMO order in Zerodha.

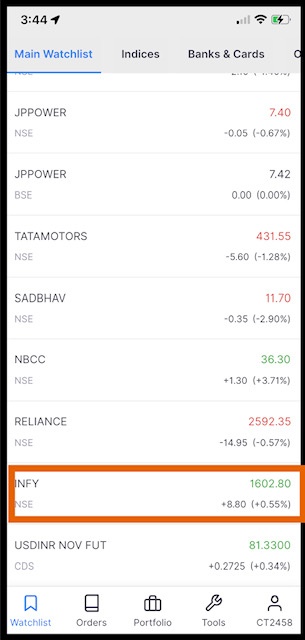

- Login to Zerodha Kite app Select the scrip in which you want to trade or invest and add it to the watchlist.

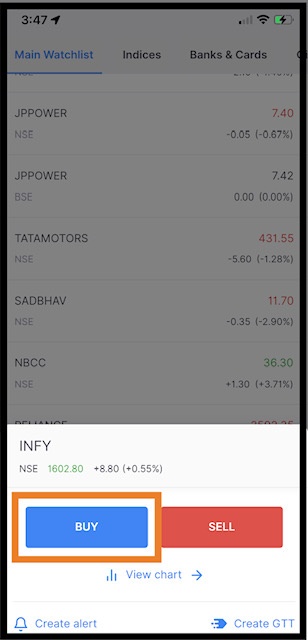

- Now click on Buy or Sell button.

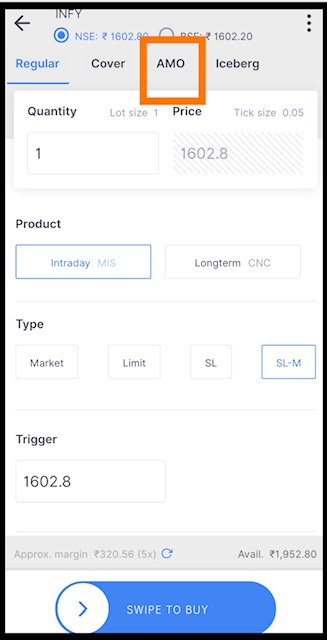

- The new window appears on the screen. Click on AMO.

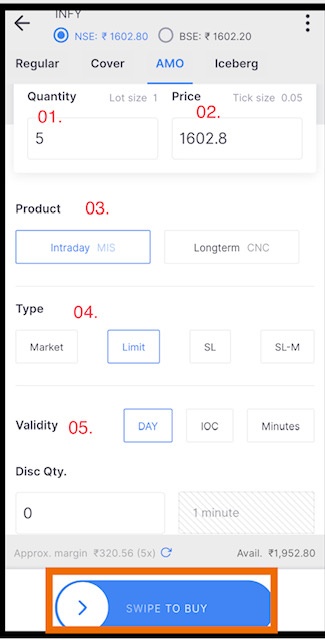

- Now,

- Enter Quantity

- Price

- Product (Intraday or Long term)

- Type (Limit, Market, SL)

- Validity (Day, IOC, Minutes).

- Swipe to place the order.

Zerodha AMO Order Validity

As shown above, you can place an AMO order in Zerodha choosing different validity that ranges from a few minutes to a day.

Also, there is an option for IOC orders where if the share is not available to buy or sell at your mentioned price then the order gets canceled automatically, or sometimes the partial order is executed.

How to Cancel AMO Order Works in Zerodha?

Sometimes, we place an AMO order, but we change our mind and does want to execute the order further. So, in this case, is there a way to cancel the order.

Yes, you can trade, modify, and cancel AMO orders in Zerodha at any time.

To cancel the order, follow the steps below:

- Click on Order Book.

- Select the AMO order which you want to cancel.

- Tap on it and then select cancel.

- Your order will be canceled.

Zerodha AMO Order Charges

Discussing any order without its charges is incomplete. So, let’s have a quick understanding of fees and know whether Zerodha charges additional charges for AMO orders?

Or

Does Zerodha charges for cancelled order?

Here is the detail of all these queries?

Zerodha is the discount broker having flat brokerage charges for all trade segments. Other than this, there are no additional fees for AMO orders.

If you are unaware of the Zerodha brokerage charges then here is the detail for you:

| Zerodha Trading Brokerage Charges | |

| Equity Delivery | ZERO |

| Equity Intraday | 0.03% or ₹20 per executed order, whichever is lower. |

| Equity Futures | 0.03% or ₹20 per executed order, whichever is lower. |

| Equity Options | Flat ₹20 per executed order |

| Currency Futures | 0.03% or ₹20 per executed order, whichever is lower |

| Currency Options | 0.03% or ₹20 per executed order, whichever is lower |

| Commodity Futures | 0.03% or ₹20 per executed order, whichever is lower |

| Commodity Options | 0.03% or ₹20 per executed order, whichever is lower |

These charges are imposed only when the trade is executed. In case of auto or manual cancellation of the order, no fees or penalty is charged by a broker.

Other than this, there are few taxes and stamp duty imposed on every trade. You can calculate the net brokerage using Zerodha brokerage calculator with stamp duty.

Conclusion

Zerodha AMO order allows the trader to take an early entry and exit in trades. It also makes it easier for the trader to buy or sell shares in the upper or lower circuit.

So, if you are not able to trade in shares during market hours then make use of the AMO order option and plan your investment accordingly.

Interested in placing trades in the share market? If yes, then get in touch with us now and we will assist you in choosing the right stockbroker and in opening a demat account online for FREE!

More on Zerodha