Equity Investment Types

More On Share Market

Many investors tend to invest in the equity segment of the share market, but only a few are aware of the Equity Investment Types.

Let’s start with the basics and first understand what is an equity investment.

Equity is a highly passive financing or investment product. It is quite famous these days due to multiple reasons.

The first one is, it renders partial ownership to the investors that means they can equally get benefited from the profits of the company.

Another reason is it provides great returns (Capital gains or Dividends) to the stockholders. Also, investors can proceed to invest with a minimal Initial financing amount.

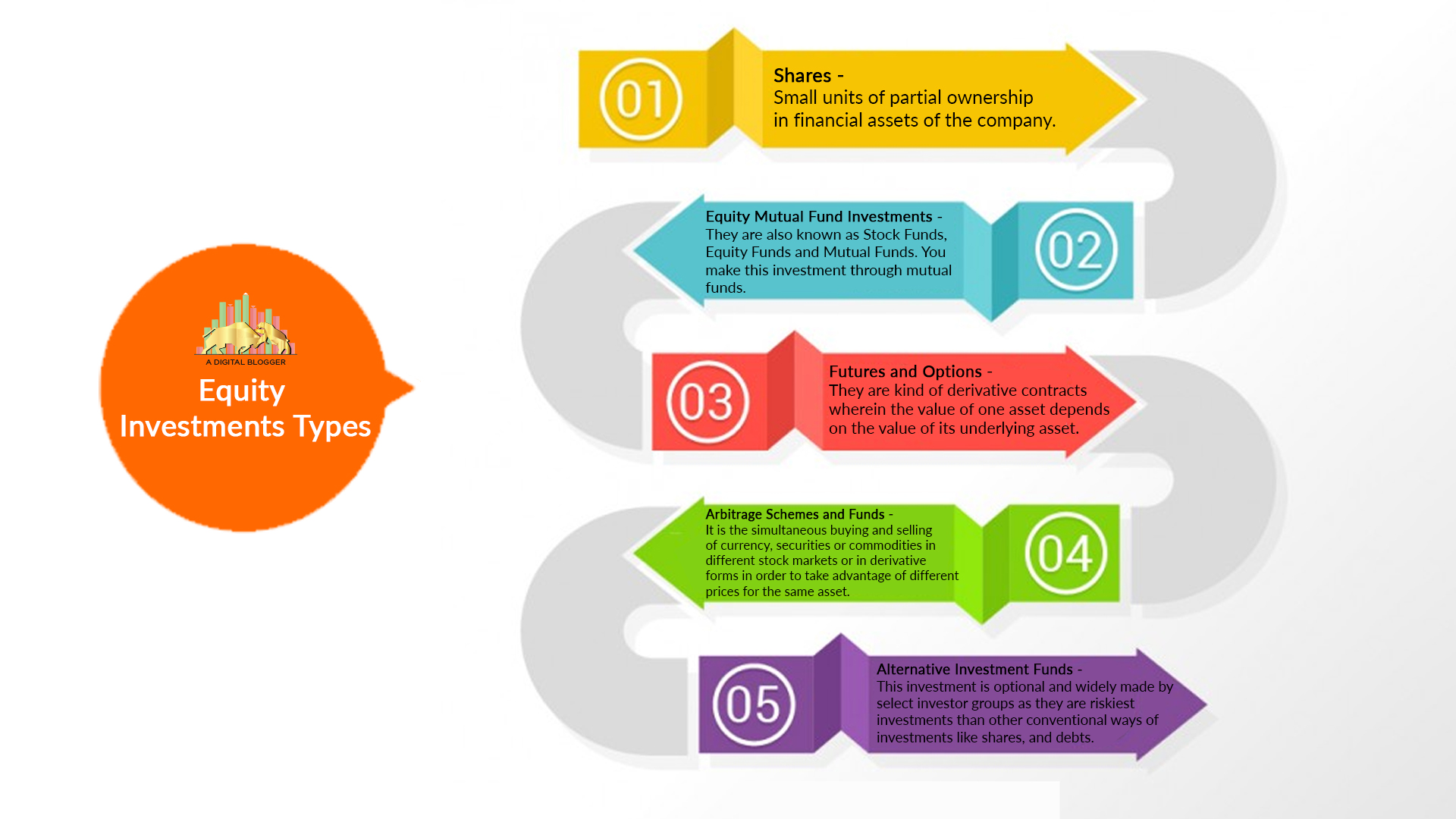

Types of Equity Investment Instruments

There are diverse types of Equity Investment that will suit you the best depending on the key factors like, how much you wish to invest in, trader’s preference, investment time period, the risk involved, and your financial goals.

Keeping all these factors in mind before any Equity Investment makes it easy and less risky for you. Here is the list of the five types of Equity Investment in India which investors can make as per their choice and suitability.

1. Shares

The first and key option is Shares i.e. small units of partial ownership in financial assets of the company. The equal distribution of shares among the investors provides them a right to have an equal share in the profits of the company.

However, in case of any loss, they have to bear the losses too.

Now the point is where these shares are sold and purchased. Well, there are mainly two types of Stock Markets or Stock Exchanges namely, NSE (National Stock Exchange) and BSE (Bombay Stock Exchange).

So If you want to list your company and want to proceed with online shares transactions safely and in less time. You need to get your company registered in these financial markets.

If we talk about how the prices of shares are decided. The ups and downs in the prices of the shares are associated with the all-in-all performance of the company.

For instance, if an investor buys shares at a low price and sells them at a higher price, there are maximum chances of profit generation and if the reverse happens, one can face losses as well.

Moreover, in the share market, the companies are categorized into Large Cap (Large market Capitalization) and Small Cap Company (Large market Capitalization).

The shares of the companies with assets having higher valuation are known as Large Cap Corporation. On the other hand, shares of the companies with assets having lower valuation are known as Mid or Small Cap Corporation.

2. Equity Mutual Funds Investments

If you do not have much idea about which stock you should invest in!! Equity Mutual Funds Investment is another best type of Equity investment available for you in the Stock market.

After this investment, you become a shareholder and mutual funds buy shares or equities from the companies and financial institutions on your behalf.

Due to the rise in prices of shares you get higher returns in Equity Mutual Funds.

In Equity Mutual Funds Investment, your returns depend on where and how mutual funds buy shares for you. Higher the capitalization of the shares higher the returns there are.

However, here you may face risks and that is why the possibility of returns is also high.

- Risk Involved – Since shares are highly volatile, investing in equity mutual funds involves higher risk. This is more if you plan to invest for the short-term.

In the case of long-term investment, however, there are better chances to gain profit or high returns.

- Returns – Moreover, returns may be low and suddenly up according to the share market. But for long term investment.

For instance, if you invest in equity mutual funds for 4 to 5 years, you can expect 13% to 15% of returns.

The liquidity in Equity Mutual Funds is low, why is it like that? see, for example, your portfolio has gone down to – 10%, here can be the situation that you do not wish to withdraw that fund.

- Volatility – Equity Mutual Funds Investment is volatile which means there is a higher possibility of rise and fall in stock prices as the share market can be unstable for a particular time period.

3. Futures and Options

Futures and Options (F&O) are kinds of derivative contracts wherein the value of one asset depends on the value of its underlying asset.

Underlying assets can be stocks, indices, currencies, items, rate of interest, and exchange rates. It is a sort of speculation in stock trading.

However, the Futures contract and Options contract both are different in some aspects. A futures contract acts as an obligation for the seller to sell the asset at a fixed price that a buyer sets.

Also, if you an intraday trader and wants to trade in Options. Then Intraday Trading in Options is available for you and you can reap its benefits.

In both futures and options, the two parties get into the contract according to which the seller or buyer has to execute the trade at a predetermined price at the date fixed today.

To understand the concept of equity investment in the futures and options let’s take an example.

Let’s suppose Rajesh wants to invest in the shares of Reliance Industries Pvt Ltd. Now seeing its current analysis you buy a futures contract for the lot size of 200 shares @200 per share that will expire after two months.

Now, if after two months, the share price reaches ₹250 per share you will exercise the contract making a profit of ₹50 per share.

Here the net profit will be lesser as the margin money you borrowed in the initial time will be deducted from your account.

On the other hand, if the share price drops to ₹180 even then you have to exercise the future contract as you are obliged to execute the trade, whatever the share price is.

Options trading, however, gives you a better option as here you have the right but not obligation to carry out the trade.

To enter into the option contract you have to pay a premium amount that gives you the choice of whether or not to execute the trade.

Here the one who pays the premium has the choice of whether or not to execute the trade.

Let’s suppose Rajesh enters into the call option with Suresh and buys an option contract for Reliance shares ₹200 per share.

The lot size contains 100 shares and is available at ₹10 (i.e. option premium is equal to ₹1000)

Now let’s suppose the share price reaches ₹300 on or before the expiration date, now Rajesh can ask Suresh to sell him the share at the contract value thus making a net profit of (₹10,000–₹1000=₹9000).

On the other hand if the stock price decreases, he has the right to let go of the option contract worthless facing a loss of only ₹1000.

With this example in place, you could easily answer basic but yet intriguing questions such as Can I Invest 1000 Rs in Share Market. Right?

4. Arbitrage Schemes or Funds

Funding in this type of equity investment is not as hard as it seems. It is the simultaneous buying and selling of currency, securities, or commodities in different stock markets or in derivative forms in order to take advantage of different prices for the same asset.

In simple words, Arbitrage is entering into opposite trade for a similar commodity having price differences in two markets so as to earn profits.

Let’s take an example of Maruti Shares, they are available at ₹4,000 in cash and the same shares are available at ₹4,440 in the future.

So here what we can do is to buy the shares at ₹4,000 in the cash market and sell them at ₹4,440 at the derivative market. You will get this profit of ₹40 after one month irrespective of share market fluctuations.

It happens because this scheme expires after every last Thursday of the month and amidst of it the cash and future get merged. There is no price impacted then.

5. Alternative Investment Funds

Apart from all the above-mentioned Equity Investment types, here comes a new one in India that is Alternative Investment Funds (AIFs). They include hedge funds, angel funds, private equity, future funds, and so on.

This investment is optional and widely made by selected investor groups as they are riskiest investments than other conventional ways of investments like shares, and debts.

After understanding the equity investment types you can make your mind about what is the best thing to invest right now and proceed accordingly.

Conclusion

So, overall there are five significant Equity Investment types which include Shares, Equity Mutual Funds Investments, Future, and Options Arbitrage Schemes or Funds, and Alternative Investment Funds.

However, they all do come with their own characteristics, risks, rewards, cons, pros, liquidity, returns, volatility, and financial goals. So consider them too before making any of these investments.

Wish to Invest in Share Market? Refer to the form below

Know more about Share Market