Penny Stocks Meaning

Check All Investment Services

Many investors think of trading in penny stocks. Are you among them? If yes, then you might be looking ahead to understand the Penny stocks meaning.

If yes! Then here is the complete information, that not only helps you in understanding its meaning but also how to plan your investment in Penny stocks.

Starting with the basic meaning of Penny stocks, they are relatively low-price trading securities with very low market capitalization, mostly illiquid, and therefore are normally listed on a smaller exchange.

These inventories are strongly speculative and widely regarded problematic owing to shortage of cash, smaller shareholders, substantial bid volumes, and sparse sharing of the information.

Penny stocks may have rates that are underneath ₹10 in the Indian stock market as they are mostly primarily linked to smaller firms.

Just because of the least demand there may not be enough buyers at the period that often makes it challenging for investors to sell the stock.

The investors can even have trouble in finding a value that correctly represents the demand owing to the reduced liquidity.

The penny stocks are efficient for the investors of the small firms who can have great patience for the risks.

On a penny stock, shareholders risk losing their entire investment and sometimes more when they purchase on margin, that further means borrowing money from the bank or broker to buy the shares.

In short, penny stocks meaning depicts that provide a higher amount of volatility which means they have a more significant opportunity for growth and, as a result, a greater degree of risk involved.

Penny Stock Meaning in India

The concept of Penny Stocks is new in the Indian stock market. Let’s delve into its history to know more about such stocks in depth.

If we have to talk about the United States, then the Penny Stocks meaning specify those stocks that are traded beneath $1 and these are the worth in pennies.

The market capitalization of all these stocks is usually less than Rs 500 crores. Furthermore, the penny stocks, as in the Indian stock market, remain volatile and have low liquidity.

Even so, there are a variety of penny stocks available on the Bombay Stock Exchange (BSE) as well as the National Stock Exchange (NSE) in India. These stocks are known as microcaps because they are smaller than small-cap firms.

Why are They Called Penny Stocks?

The exciting part is to know why are they called penny stocks? To understand the same, it is required to understand the reason. So let’s begin to grab some more information on the same.

In India, the stocks of pennies in India frequently find themselves incompatible with exchange rules and reporting transparency.

Because several traders that purchase penny stocks just don’t really feel responsible and take a glance to leave sooner or later when they have good returns, because of which the penny stocks trade at these low rates for a purpose.

The speculation contributes to improved trade volumes and higher prices. However, very few of them come out to be correct or genuinely crucial.

Penny stocks just change whenever there is some kind of coverage or a report about a turnaround. Any bad news sends the price plummeting.

How to Trade Penny Stocks?

After understanding penny stocks meaning now, if you are curious about how to trade penny stocks, then check this suitable segment that will discuss the same query.

Basically, in the penny stock market, the hedge funds that are loosely regulated along with the speculators and the short sellers are the regular participants.

Along with ETFs and mutual funds are the segments that are being traded in the penny stocks. The penny stocks pull the people who can get comfortable with the trading along with the higher risks involved.

To trade into the penny stocks, it is possible with the following steps:

Choosing a Stock Broker

Try to ensure that every broker you choose abides by the SEBI’s regulations. They ought to be able to provide you with the clearly written actual research on the investments which they’re recommending.

Now here comes the choice of discount and full-service stockbroker. On one hand, where a discount broker offers you brokerage services at minimal charges, the full-service stockbroker although charges high brokerage but provides additional services like research tips, etc.

Compare the services and pick the one that goes best with your requirements and trading experience.

Open a Demat Account

After choosing a stockbroker, the next important step is to open a demat account with the firm. For this, you can either apply online or offline. Consider the opening charges and AMC to pick the best stockbroker in India to open a demat account.

To make it simple, here is the form, fill in the basic details and get the demat account for free.

Research Penny Stocks

Scams can be avoided by doing extensive research on businesses. Unauthorized emails, chat groups, and cold calls should be prohibited.

Alternatively, get reliable details about an organization you’re engaged in by contacting the state securities regulator or the SEBI.

You can make efficient use of the trading platforms and apps provided to you by the broker. A proper fundamental and technical analysis of stocks can give you a clear insight into picking the right penny stocks to invest in.

Determine Best Time to Trade in Penny Stocks

Apart from this, timing the market is important to prevent yourself from losses. After carrying out the research you need to determine the time or period at which buying or selling that particular Penny stocks proves to be profitable to you.

Invest in Stocks Safely

As the name and Penny stocks meaning depicts, these stocks are highly risky and come with the great potential of losses. It is therefore good to consider the amount you are planning to invest.

Make sure you invest the amount that you can afford to lose in the entire trade of penny stocks.

Are Penny Stocks a Good Idea?

After gaining much information and Penny Stocks meaning now you might be wondering that are Penny stocks worth investing in?

Penny stocks have such a good chance of satisfying their investors. If you could somehow find a suitable penny stock, the yields are very huge. For several investors, penny stocks have proved to be multi-baggers.

These stocks have the potential to move rapidly. In only a few months, a variety of penny stocks actually returned several times their initial investment.

Furthermore, because of the lower selling price of all these stocks, investors can purchase a great amount of them.

Penny stocks are commonly unknown to the general public, although individual investors are unaware of them, and institutional investors avoid investing in them due to their small market capitalization.

As a consequence, if you could somehow identify one such stock before even the market does, it might prove to be a significant capital generator for investors.

Some of the platforms describe penny stocks to be risky, but for that, it is important to check the data and understand the concept.

What Are The Best Penny Stocks For 2021?

If you have made the mind to invest in penny stocks, then it is important to have some knowledge about the penny stocks that can provide you with good returns.

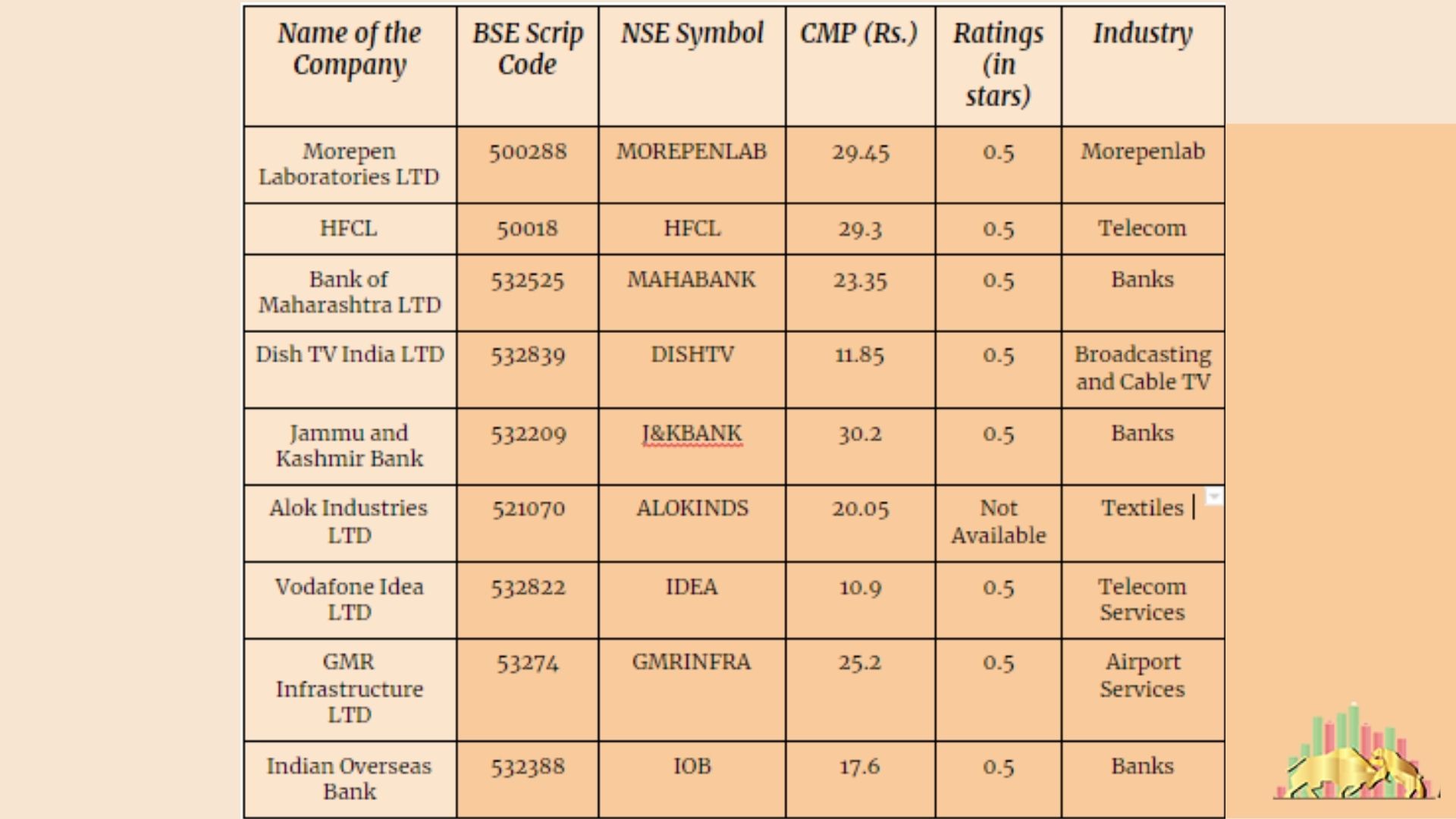

Here are some of the best penny stocks to buy now in India.

The above-mentioned table indicates the penny stocks of 2021, which can provide an excellent profit to the investors.

Should You Buy Penny Stocks?

Penny stock trading, on the other hand, can be a fantastic source of revenue with that the potential to generate returns if you really can handle a little threat and react fast on your feet.

Trading penny stocks come with a lot of pressure and confusion, so not everyone can do this.

When you have got a basic understanding more about how to benefit from penny stocks, you could further use your education to become a professional.

To understand the concept, move to another segment of making huge money along with the penny stocks.

Can You Make Money In Penny Stocks?

Till now you might have understood the meaning of Penny stocks. Now the question arises, can you actually make money by planning your investment in the stocks that already have a low value.

Well to get on the right track of trade, one must follow the basic and most important principle of prioritizing the value of stocks rather than the cost.

This helps in picking the potential penny stocks with good returns.

Which Broker is Best for Penny Stocks?

As we have already covered that before getting into trade in the Penny stocks it is essential to choose a stockbroker that can offer you the lowest brokerage charges and a highly advanced trading platform. So which broker to pick to invest in Penny Stocks?

Wondering?

In the terms of full-service stockbrokers, the larger number of brokers in India went through the procedure of minimum brokerage per share.

But, here, the stockbroker, i.e., Samco, comes to the forefront for helping to trade in penny stocks. Do you want to know the reason? If yes, consider the following piece of information.

- The discount brokers, on the other hand, charge a fixed fee of ₹20. It just never exceeds the broker’s pre-determined brokerage fee.

- The relevant brokerage when trading penny stocks with Samco in intraday is ₹20 or o.2% for each performed transaction whichever is lower.

- But the brokerage when trading penny stocks in delivery are ₹20 or 0.2 percent, whichever is lower.

- It offers a reliable, advanced, and user-friendly trading app Stock Note that helps you to learn how to analyze stocks and conducting seamless trade.

It is better to connect with Samco to trade in penny stocks. So what are you waiting for? Get into trade with the renowned stockbroker by opening a demat account for free.

Conclusion

Summarizing the whole concept of Penny stocks meaning, it although comes with risk is analyzed in the right way can help the trader to make a good profit over the period of time.

It is always suggested to follow the right strategy in picking the stock and depending upon the analysis tools that helps in withdrawing good chunks of money from the stock market.

To open a demat account, fill in the basic information below:

More on Share Trading