Rules of Share Market

More On Share Market

The Share Market world offers numerous investment opportunities for your money to grow up. You can trade or deal in the market as per your choice and convenience.

There are some best trading apps in India that make trading simpler and easier for the user . You need not meet the broker to buy and sell the shares, as online trading allows you to do the same from any part of the world.

Online trading requires your mobile phone and useful internet.

Besides, there are two types of trading that you can carry on. They are Intraday trading and Delivery trading.

- Intraday Trading – It is also called Day Trading. You can buy and sell the stocks and other financial instruments on a similar day in this kind of trade before the stock market closes.

- Delivery Trading – Here in this trade, you can exceed stocks’ possession for a long time, like weeks, months, and years.

When you buy the stocks, they are sent to your Demat account for further trading. You can sell them whenever you want.

Rules of Stock Market Trading

In the share market, most people come to earn maximum money. They think that within months their money will get doubled. So, they spend all of their money in the stock market, and even some people borrow money from their dear ones to invest.

But what happens? All money gets destroyed, and they get demotivated because earning money in the share market is not that easy. There are many ups and downs in the share market.

So we are not able to understand which shares we should purchase, hold, and sell. There is no fixed formula and shortcut for earning profits in this market.

Therefore, today we will talk about some of the basic rules of Share Market that will provide you ideas of how you can be a part of SEBI and its exchanges to some extent. So let us begin!!

Eligibility:

Investing in stocks is the way to earn passive income, but when it comes to how to join share market, one has to check a few eligibility criteria.

Here are the details for you:

(1) The individuals who wish to trade on any exchange (NSE or BSE) have to register themselves with the SEBI of India.

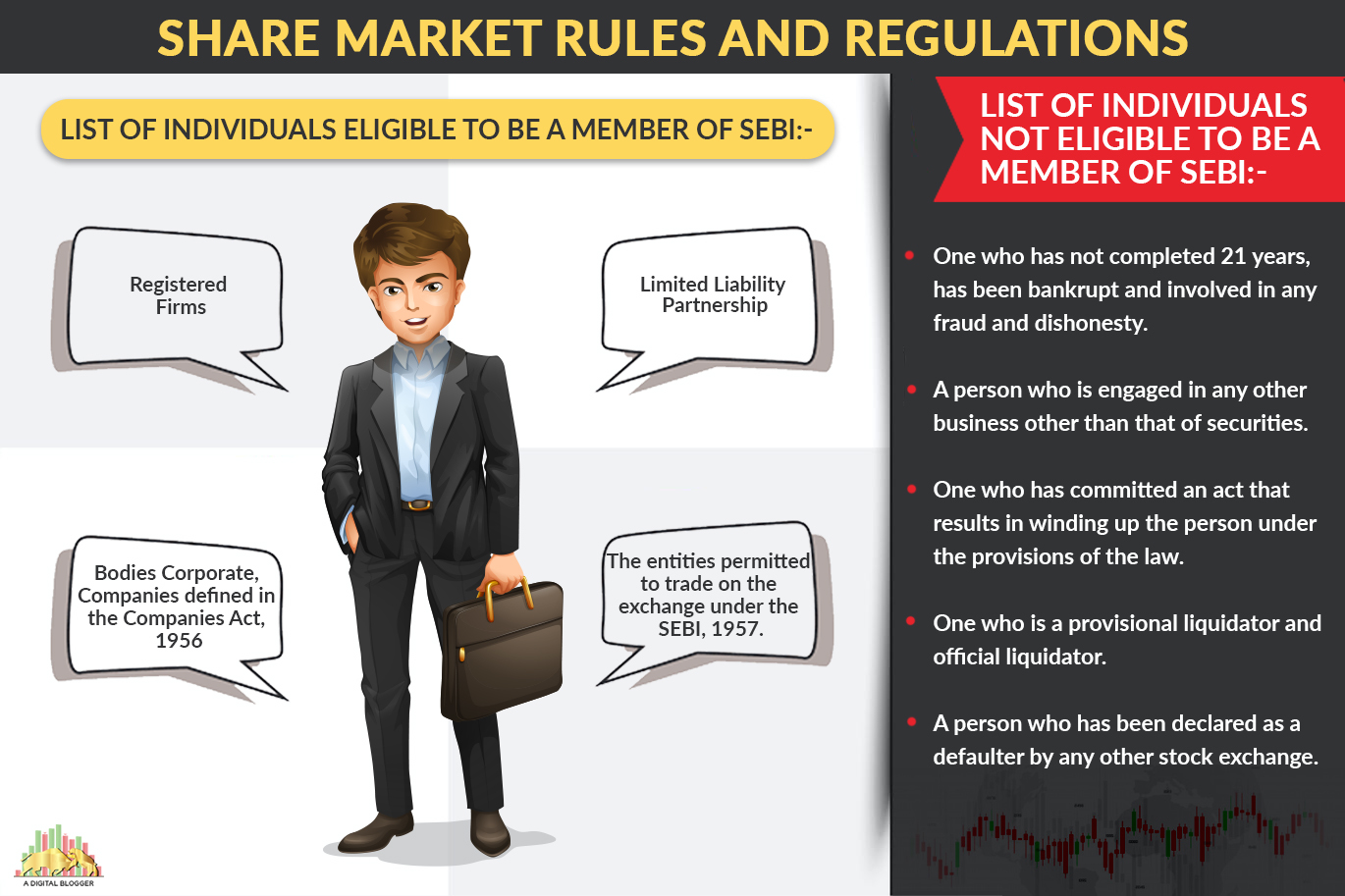

(2) Individuals who can take part in SEBI involve;

- Registered firms

- Limited liability partnership

- Bodies corporate

- Companies defined in the companies act, 1956

- Entities that have permission to trade on the exchange under the SEBI, 1957.

(3) Besides, the individuals who are the trading members of the TRM segment are also eligible to trade on an exchange.

(4) An Individual is not eligible to be a trading member of the exchange who

- has not completed 21 years.

- is engaged in any other business other than that of securities.

- has committed an act that results in winding up the person under the provisions of the law.

- is a provisional liquidator and official liquidator.

- has been bankrupt.

- has been involved in any fraud and dishonesty.

- has been declared as a defaulter by any other stock exchange.

(5) No individual is eligible to take a trading member of the exchange.

- If he has not been a partner with any stock exchange for two years or more. Besides, who has not worked as an authorized clerk, assistant, or apprentice to a member of any recognized stock exchange for the same time period.

- An individual who is a representative partner with any member of an exchange and also enters into transactions but not with his name but the name of the member under whom he is working.

- An individual who is not successful in the established business of a deceased or retiring member (father, brother, uncle, close relative) of the exchange.

Rules of Share Market Closing

You also need to be aware of the Share Market Account Opening and closing timings before investing and trading in the financial markets.

The standard stock market timings in India or continuous trading timings are the same in two major stock exchanges: NSE and BSE. The share market opens at 09:15 AM and closes at 03:30 PM.

Once you get to know the Share Market Account Opening Hours, you can buy, sell, and trade in shares from any part of India during business hours.

However, there is also a pre-opening session that starts at 09:00 AM and extends to 09:15 AM. And, Post- opening session begins at 03:30 AM and extends to 04:00 PM.

Off Days of Indian Share Market

- Stock Exchanges holidays

- Saturday & Sunday

New Rules of Share Market

Suppose you have to sell a mobile phone worth Rs. 10,000, and a buyer is also ready to buy that in the same amount. Your deal is just about to finish, and it is time to receive the money.

In the meanwhile, the government interrupts and says that you should have a minimum of Rs. 5000 in your bank account only then can you sell this mobile. It is shocking and confusing, isn’t it?

SEBI has also come with a similar rule in 2021. If you want to sell Rs. 1 lakh’s shares, you should have 20,000 as cash in your trading accounts. Similarly, there are other rules that SEBI has brought for you !!

- You cannot use the money you earn after selling the shares immediately for buying the new shares.

- Less leverage will be given to you. You cannot buy more shares with less amount. Leverage means the money that a broker gives to you for some days from their side to buy more shares and get more brokerage.

- Even for selling the shares, you will need a margin. You are liable to transfer the money into your account. For buying the shares, you will have to pay more margin. Margin means the nominal amount which you have to pay to the broker.

It is advisable to know How to enter in the Stock Market? after knowing the Share Market rules so that you can reap the benefits of trading.

SEBI New Margin Rules

Here comes another new rule related to margin trading in the stock market. According to this rule, the brokers would now be able to provide the maximum margin up to 5x.

This intraday trading rule is going to be effective from 01 September 2021 will not only affect the traders doing intraday trading by reaping the leverage benefit but also the broker who was able to maintain a good client base by offering a high margin facility.

A reduction in the margin by 75% will impact many more sectors.

Conclusion

After going through this article, you have had an idea of which conditions you will need to consider for being a trading member of the exchange and at which time you can trade effectively in the share market.

Besides, make sure to do trading during trading hours (opens at 09:15 AM and closes at 03:30 PM).

Want to start trading in the Share Market? For that, you need to open a Demat Account. Refer to the form below

Know more about Share Market