Bull Market

Most of the time you have heard or read about the “Bull Market” in the newspaper or Television.

The concept of Bull Market is very old in the stock market and it is one of the powerful kings of the stock market that produce the ups in the markets.

If you are a new investor or trader beginning its footsteps in the stock market securities. These include Equity, Derivatives, Currency, Commodity, IPO, bonds, etc., so it is very crucial for you to understand the Bull Market term.

Through this document let’s understand the importance of the Bull Market, some interesting facts and figures, its examples, and know whether it is good while investing or not?

Bull Market Meaning

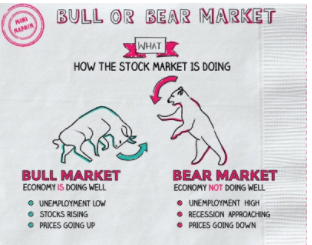

Bull Market’s meaning is quite simple and self-explanatory. As you might have seen a bull raising its horns in the upward direction; in that similar way, the condition in which prices go high is called a Bull Market.

That was simple. Isn’t it?

Technically, the phase in the stock market when the prices tend to reach a peak in continuity over a period of time is called the “Bull Market”.

Many buyers become optimistic during this phase when prices rise above because they could buy the shares with a profitable return.

This usually happens when the Gross Domestic Product (GDP) of India is high and the employment level is high too.

According to John Templeton, “Bull-markets are born on pessimism, grow on scepticism, mature on optimism and die on euphoria.”

Bull Market = GDP ↑ Employment ↑ Stocks ↑ = Everything going UP

Generally, the investors who buy shares at this phase are termed as “Bull”. Usually, Bull Market tends to last for a certain period of time like a month or two or even years.

Although it seems to be unpredictable to determine the Bull condition in the market, however, certain aspects can be taken into consideration such as:

- Is the GDP of the country rising?

- Is unemployment low?

- Are the prices of stocks and shares increasing?

- If yes, for all of the above, then how long has it been?

In the financial segment, the bull market term is usually to opt by the investors to demonstrate the economic condition of a country that is rising swiftly.

According to Aasif Hirani (Director at Tradebulls Securities), “Banking and financials have been at the core of any bull market in India followed by infrastructure, which usually starts participating at the high momentum stage.”

Bull Market Example

There are certain Bull Market examples that will help you to understand the condition more quickly and smoothly.

As discussed above, Bull Market can be seen if the GDP of the country is high, Unemployment is low and the prices of stocks and shares are increasing rapidly.

Nevertheless, apart from these, the latest innovations in technology and the emergence of new and strong companies that encourage people to make investments in various segments also create a Bull Market.

The last five bull markets in India were on Dalal Street in which the top prolific leaders were from three leading sectors which include Industrials, Banking, and Metals.

Let us see if the same sectors will roar again?

The most productive bull market occurred in 2000 during the dot-com bust when many firms inspired investors and traders to invest in the stock market, which significantly created a condition of Bull Market for the 10 years.

Also, From the year 2003 to 2008, these five years India’s Bombay Stock Exchange (BSE) index increased from 2900 points to 21000 points creating a condition of the bull market.

Crash in the Indian stock market when the Sensex rose by over 98% from Dec 2011 to Mar 2015, is another example of a Bull Market.

The most recent and longest Bull Market condition happened in US stocks where after 11 years (2009 to 12 Feb 2020) Dow Jones Industrial Average entered a Bear Market falling from 6,594.44, to 29,551.42 with a return of 348%.

Surprisingly, the US stock market received a rapid and dramatic increase in the stock prices by 582% during the year 1987 to 2000.

Bull Market In Stocks

Bull Market in stocks holds a very accountable position as it determines the pattern of the stocks. For the value investor or trader, Bull Market is considerably important as it creates a plethora of opportunities to strengthen their Equity Investment Portfolio.

Also Read: Equity Investment Types to reap the benefits of investment.

The condition of the Bull Market in Stocks has been seen for a very long time over the last 20 years. On average, the condition lasted for an average of 32 months in the stock markets.

Bull Market Indicators

As an investor or trader in the stock market, it is very important for you to predict the Bull Market condition before buying or selling stocks and shares respectively.

Whenever it occurs or is going to occur, you must have pre-knowledge about the same otherwise you will not earn profits.

Apart from the rise in the stocks or shares as the key Bull Market indicators.

Just thinking that a short-term fluctuation in the stocks will lead to a Bull Market, will surely get you in financial trouble as it must occur for a certain period of time.

Let us have a deeper understanding of the important Bull Market Indicators.

Some of the prime Bull Market indicators are as below-

- The GDP of the country is rising gradually.

- Unemployment is getting low as compared to past years.

- A rapid rise in the price of stocks, shares, and indices

- Demand for stocks is increasing swiftly.

- Increase in the number of Investors buying stocks

- Selling of stocks become limited

Always remember that after a while stocks and shares come up and go down. All you need is to predict that “UP” condition simply by focusing on the above indicators carefully.

Bull Market Trading Strategies

Investors who wish to earn maximum profit from the trading and investment segments listed by NSE and BSE should take advantage of rising prices by buying them as soon as possible.

Simultaneously, selling these stocks or shares in a profitable time is also important. However, determining the “buying” and “selling” times could be challenging since the prices fluctuate most of the time.

Below we will understand various Bull Market Trading Strategies that will help an investor to minimize the loss by following them effectively:

- Buy and hold approach – The Buy and Hold approach allows an investor to buy a certain amount of stocks or shares at a particular time when they are exceptionally available at a low price and the investor has an optimistic view that the prices will rise in the coming future.

- To make this approach more successful, it is highly recommended to follow the past months or years’ statistics of that particular trading and investing segment before putting up your money.

2. Following Swing Trading – Another way of earning extensively during or before the Bull Market is to follow the swing trading pattern. It is one of the most aggressive methods of trying to capitalize on a Bull Market.

- Through this strategy, an investor will play an active role in buying and selling the stocks or shares by considering short to medium-term gains. This strategy is often used for a certain period of time such as days or weeks.

- An investor actively strives to gain maximum profits from the stocks by trading for a couple days as the transformation happens within the conditions of a large bull market.

3. Additional Buy and Prolonged Hold Strategy

- Additional Buy and Prolonged Hold strategy is quite a bit different from the above Buy and hold approach as it requires extra risks.

- By undertaking this one of the Bull Market Trading strategies, an investor will regularly buy a share in a particular trading segment and will keep on adding that in his account for a longer duration.

- When the stock price increases from its pre-set amount, the investor or trader will continuously buy an extra fixed amount of shares in his Demat Account.

Bull Market Candlestick Patterns

There are certain Bull Market Candlestick patterns that are an important financial tool used widely for the technical analysis of the stocks. And, understanding these patterns will give you a clear glimpse of the Bull Market.

To learn stock market analysis you can enrol yourself in different stock market courses that give you clear insights into the technical analysis of how to buy stocks for long term.

Bull Market Candlestick Pattern includes the below structure-

- Body

- Head

- Tail

- The body comprises the central part of the candlestick pattern representing the opening and closing amount. The closing is always above the opening part, which is at the very bottom of the body.

- Head in the Bull Market Candlestick patterns is also referred to as Upper Shadow which connects the closing amount to the high value.

- The tail is the very bottom part in the Bull Market Candlestick Patterns linking open value to the low price.

Also Read: Candlestick Patterns

With the help of various Bull Market Candlestick patterns, an investor can create strategies to increase the chances of winning the trade.

Where To Invest In Bull Market?

During or at the onset of the Bull Market, an investor must carefully find those areas where he can invest to earn more profits. To make it more clear and precise, let us go through the following key points to know where to invest in Bull Market:

- During Bull Market always buy stocks or shares of a company that is moving towards upwards for a specific duration. It will be beneficial if you check the previous record of the company to know the price flow.

- The company having good sales and earnings will allow you to earn more in the stock market. Comparing its previous earning reports will help you to know at a glance whether it will be profitable or not. If it is earning well and the public demand is increasing for their product then, this company is a better choice to invest in Bull Market.

- What to Invest in stocks is the main question that arises most of the time. The best thing that you can do is to invest in stocks that are more aggressive choices than others at a particular period. Try to buy the stocks of that particular trading and investment segments and keep on checking the statistics and make a report

- Choosing appropriate industries will give you a financial boom too. Pick up the sectors that experience growth such as automobiles, Technology industries, Housing products, and industrial equipment, etc.

Bull Market Crash

There were various crashes that hit the Indian stock market badly. There are around 4 major crashes that occurred in India and usually, there are three main causes of the crash:

- Unexpected economic condition

- Tragedy

- Sudden crisis

Also, there were some crashes that happened during the Bull Market when it reached an unsustainable level and prices rose rapidly.

Read Also: Top 5 Stock Market crashes ever happened?

Here is one of the examples of the Bull Market crashes that ever happened in the stock market:

Stock Market crash 1929:

- The Stock Market crash India of 1929( also known as the Wall Street Crash or Great crash) was the most major American crash ever in history.

- It happened just before the Great Depression followed by the London Stock Exchange crash of September.

- In the leading days of the crash, the market was devastated and affected severely.

- The Stock Market experienced Bull Market due to the rise in the volume and demand, the prices rose dramatically.

- Later, they fell so rapidly that huge losses occurred in the history of the United States.

Is Bull Market Good?

A bullish market is a condition in the stock market when the demand is higher than the supply of shares. Subsequently, it results in the rise of the share prices.

It is wise that an investor buys more shares during a bearish market as the shares are available for cheap and sell his/her shares during a bullish market as more people are looking to buy during this time and you can sell your shares at a higher value and earn a profit.

Hence, Bull Market is a good choice and is preferred by the majority of investors. Typically, a stock market in a Bull Market condition has offered positive returns to the investors and traders over a period of a long time.

During the Bull Market, any losses will be minor and temporary and further, an investor can opt for the aforementioned strategies while trading in the Bull Market.

Sometimes the Bull Market occurs naturally i.e. when the GDP and the demand for the product rise. However, there are certain times when a crash has occurred and resulted in a Bull Market.

Conclusion

As we have concluded the concept of Bull Market in India is old as the word suggests when the price go up and encourage buying shares is called a Bull Market. It’s all about playing with stocks.

There are some strategies as well such as Buy and hold approach, Following Swing Trading, Additional Buy and Prolonged Hold Strategy and the famous one is Candlestick Patterns.

So, this phase comes once in years in a certain period of time. Play with stocks when it comes.

Willing to open a demat account, please refer to the below form:

If you are looking to know more about the Indian Share Market basics, here are some reference tutorials for you: